I hope that this note finds you doing well!

It has been an extremely busy summer for our family with trips to some really cool spots around the globe. School starts next week here in California, so the end of summer is quickly approaching.

Both of my kids said it was their Best summer ever, so I felt pretty good about that!

HOUSING

If you watch CNBC or read the local paper you would think that we are on the cusp of a massive correction in residential real estate. If we look at the runnup in housing prices and the increases in mortgage rates in isolation, then yes, you could make a case that we are due for a correction.

In September of 2022 I wrote a post titled, Housing, A Contrarian View in which I outlined why I did not think the housing market was vulnerable to a significant correction in price. There are a lot of great charts in that post which I think are still relevant today, below are a few charts with updated data.

First, only 2% of mortgages in the United States are variable rate mortgages. This means that most 98% of homeowner who stay in their home will not be impacted by higher mortgage rates.

Second, the average mortgage rate in the United States is currently 3.6%, up from 3.3% when I wrote about this in September 2022. We can expect that this number will drift higher as new buyers enter the housing market. But there is a strong incentive for existing homeowners to stay put.

Third, homeowners have a massive equity cushion which insulates them from a price decline, even an extreme event like 2007 - 2011 where home prices dropped 26.2% would only return the market 2019 levels.

To summarize the above, homeowners have low fixed rate mortgages with a lot of equity. I think this is why we are seeing such low existing home inventories and sales data. Why would you move if it means doubling your mortgage interest rate and bumping your property taxes 40% for the same or similar house?

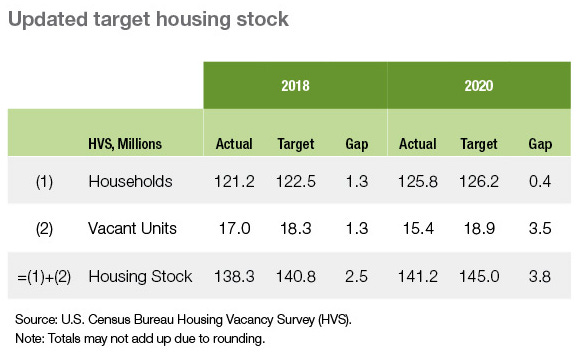

Add to the above a structural shortage in housing, which according to the most recent estimates from Freddie Mac show that the United States is short approximately 3.8 million units of housing, both for-rent and for-sale. Meaning there aren't enough homes to keep up with the number of new households that are forming every year.

So it is no wonder that home prices have barely moved over the last 12 months. In June 2023, U.S. home prices were down 0.74% compared to last year, selling for a median price of $425,571. The number of homes sold was down 15.7% year over year with 519,186 homes sold in June of this year, down 615,929 homes sold in June of last year.

The drop off in existing homes for sale and the tepid recovery in new home starts leads me to believe that the housing market will remain relatively robust through 2024. In fact, I think that the lack of existing homes for sale has really opened the door for new home builders and we are seeing that reflected in their record high stock prices.

A second derivative of the structural housing shortage is the many prospective homeowners will need to rent a home longer than previously anticipated. Below we can see that vacancy rates for rentals remain near all time historic lows, although new construction of multi-family housing does look promising.

In short, in spite of mortgage interest rates doubling, the outlook for housing remains relatively steady due to a shortage of supply, existing homeowners that have no economic incentive to move (reminiscent of Prop 13 in CA) and a strong economy / consumer benefiting from low unemployment, etc.

Check out the homebuilder construction index ETF below…..

PODCAST / VIDEOS:

GERONTOCRACY: I try to stay away from politics, but this video breaks down the history of the Gerontocracy in the United States as politicians on both sides of the isle are consistently revealing that it might be time to retire.

Peter Santenello on America: This is a bit dated video from 2021, but offers an interesting perspective on the challenges currently facing the United States. Peter has an interesting perspective returning home after having traveled to 85 countries.

The ALL-In Summit: September 10 - 12, Los Angeles, CA - This will be my first time to attend this conference hosted by my favorite podcast on all things tech / economy.

Middle East Region: September 18 - 22 - I will be in the Middle East meeting with current and potential LPs, please reach out if you would like to connect.

SACRS Fall Conference: November 7 -10, Rancho Mirage, CA - This is a great conference to catch up on multiple asset classes with top investors and consultants.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.