HOUSING, A CONTRARIAN VIEW

ISSUE # 79

Hi All,

In case you missed it, the FED increased it’s benchmark interest rate 75 basis points today, the third 75 basis point increase in a row. The FED funds rate range is now 3.0% to 3.25%, the highest level since 2008. The Fed’s forward guidance via the dot plots indicate 4.40% in 2022 and 4.60% in 2023. Separately, the 2 year Treasury Note is yielding over 4% for the first time since 2007, more here.

As global Central Banks exit a Zero Interest Rate Policy (ZIRP) regime and shift from Quantitative Easing (QE) to Quantitative Tightening (QT), expect volatility in the markets to remain very high for an extended period. The Dollar continues to benefit from higher relative rates, which will put pressure on economies around the world who are also trying to fight inflation. The US Dollar is truly the “Wrecking Ball”.

HEDGEWEEK AWARDS 2022:

Prime Meridian Capital Management has been nominated by Bloomberg LP in two categories of Hedgeweek's US Awards for 2022! Specifically, for Best Multi-Strat Credit Hedge Fund and Best Direct Lending Credit Hedge Fund in the United States. Voting closes on Friday, September 23rd, 2022.

Please follow the link to VOTE for us in both categories, https://lnkd.in/ejYUWVDp

Your support is much appreciated!

HOUSING, A CONTRARIAN VIEW

There are a lot of discussions in the media on an impending collapse in housing prices. I think it is likely that we have in fact seen a near-term peak in housing prices and that there will be a modest correction as higher interest rates impact affordability. But, I do feel that there is a strong floor under the market and here is why….

First, the consumer balance sheet is relatively unlevered and credit scores remain very strong.

Second, homeowners have a substantial amount of home equity.

Third, homeowners generally have fixed rate mortgages in the United States and will not be subject to increasing payments via variable rate loans (UK, etc.).

Fourth, mortgage rates on existing home loans are locked in at extremely low levels, and borrowers are unlikely to be able to refi those loans at those levels in the near future.

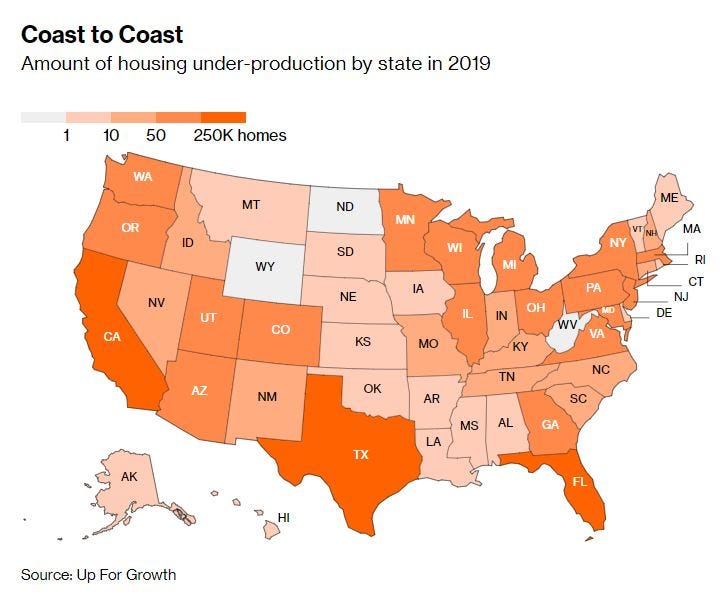

Fifth, while housing prices have been strong over the last decade, price appreciation is roughly in line with the CPI Index and there remains a significant shortage of homes across the United States.

To summarize, there is a shortage of housing, homeowners have a lot equity and low fixed rate loans. In short, homeowners are in much better shape today than they were in the 2008/09 sub-prime housing bubble.

From a macro view, if you are a homeowner, do you sell your house and establish a higher base rate, which means higher property taxes and a loan at a higher interest rate? Common sense tells me that these factors and uncertainty around the economy generally will keep homeowners sitting tight, which will keep the supply of homes for sale tight. New construction will be hampered by economic uncertainty, high labor and input cost, difficult permitting, etc.

That means less supply in the existing home market and probably fewer home sales generally. The media will hype this up saying home sales are falling and prices are being reduced, but remember that it is likely a function of the above factors. Yes, home prices will likely come off record high levels, but I don’t expect a crash like the one we saw 2008/09. The above conditions put a solid price floor under the market.

VIDEOS | PODCAST:

THE BREAKDOWN: In this episode, Nathaniel Whittemore aka NLW, takes us through the Ethereum Merge. This one is short and sweeet if you just want to get the quick 411 of what happened last week in Ethereum.

BANKLESS # 136: This episode covers the Ethereum Merge in a bit more detail and other news of the day in the DeFi space.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter