ZIRP & MARKETS

Issue # 38

I hope that this note finds you safe and healthy.

MARKETS:

There have been a lot of questions surrounding the stock market’s relentless march higher and the disconnect with fundamentally lower earnings. I think the conversation is well founded and worth having.

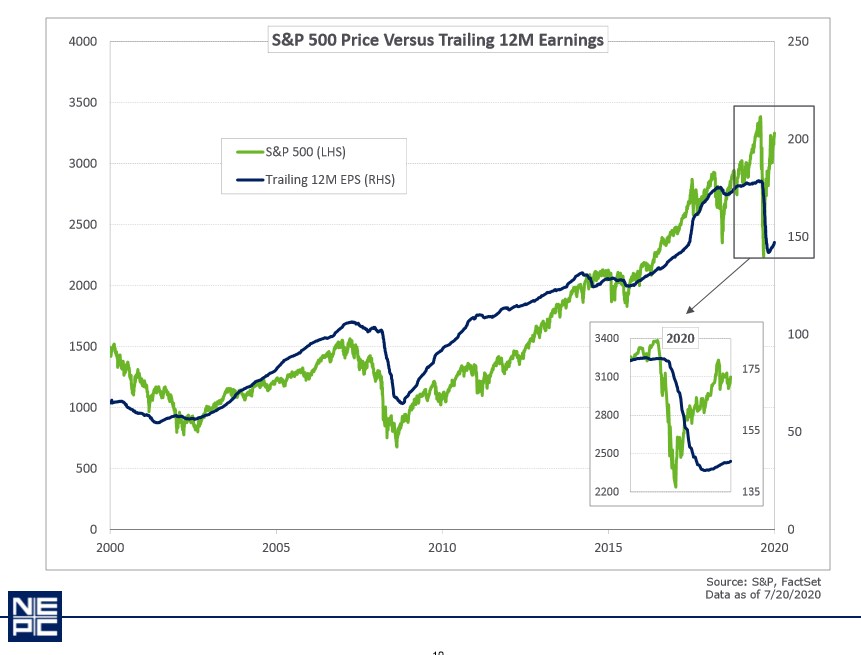

To frame the conversation I am including a chart from our investment consultants Don Stracke and Dan Hennessy of NEPC. The green line represents the stock market and the blue line represents trailing 12 month earning per share. Normally the two lines move together as you would expect, but since the Covid-19 pandemic they have decoupled.

One explanation is that investors are looking through or beyond the current pandemic and if you believe that earning will only be affected for 12-18 months and then recover to pre-covid levels you are correct to maintain a bullish stance. The impact of one year of lower earnings is relatively minimal on the dividend discount model.

Another explanation and my preferred explanation is that it is not about earning at all. What matters now is what the central banks and policy makers are doing. If you have been reading my blog you will know that my opinion is that the zero interest rate and quantitative easing policies are driving the inflation of financial assets. We didn’t learn this in Macroeconomics 101, but Martin Zweig always said do not fight the Fed!

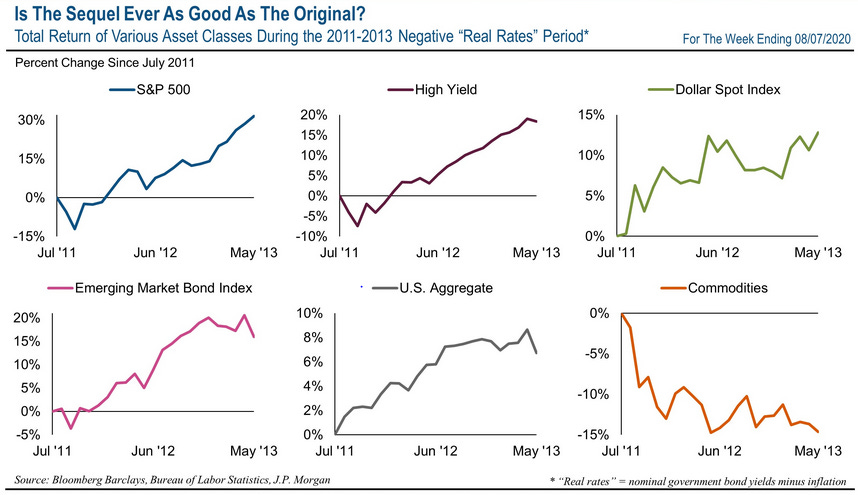

So what happens when the Fed keeps rates at or below zero, when real yields are negative for an extended period? It forces investors to “reach for return”. We last saw this in the mid2011-mid2013 period when equities, bonds and the dollar all did well. The chart below is courtesy of Payden & Rygel.

How BIG is the current Quantitative Easing?

Below is another great chart from Payden & Rygel that illustrates the magnitude of the current QE programs by comparing them over rolling six month periods. When you see today’s actions versus the actions taken during the Great Financial Crisis of 2008/09 today looks like a Tsunami.

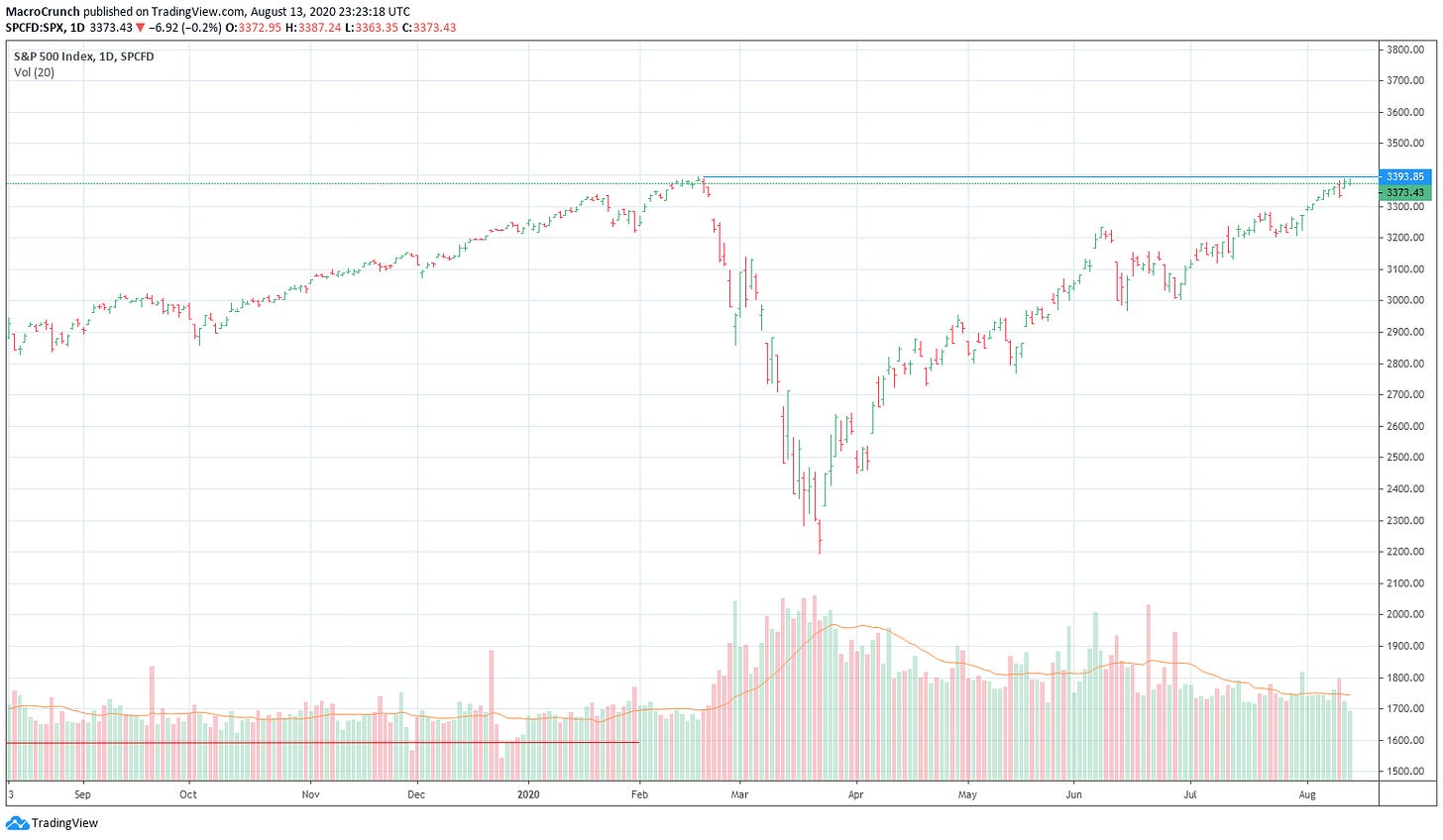

When I look at what is occuring with the central banks QE and ZIRP policies, it tells me that at a minimum this is not a good time to be short and if you must be short financial assets try to use options to limit your risk.

I continue to maintain a relitively defensive portfolio posture, but if the markets make new highs (see SP500 chart below) I will have to reconsider and take all of the above into account. Until then I am proceeding with caution!

TECHNOLOGY:

Yesterday the New York Times published an interesting article on Momentum Dynamics, the leader in wireless charging for commercial vehicles. Sharam Honari an old friend and a very talented investor first introduced me to the company a couple years ago when we were discussing the future of green transportation.

The New York Times article discusses the city of Oslo’s plan to roll out a pilot program for taxis that will charge wirelessly while they wait for their next customer. We are already seeing the Momentum Dynamics technology deployed for buses here in the United States and Canada.

But what struck me as particularly interesting was the CEO’s comments that “autonomous vehicles — cars with no drivers — working urban and suburban routes will be particularly well suited to wireless, touchless charging systems”.

Think about that for a second, an autonomous car that is able to maintain a charge with out a human. That would be pretty crazy and it would lead to the commoditization of transportation at a grand scale. Transportation would become a utility and it would no longer make economic sense to own your own car. The car would be like a horse, something that you enjoyed on the weekends for pleasure!

PODCAST:

The End Game: You know that it is a good podcast when several friends send it via text within hours of each other! On this podcast they discuss arguably one of the greatest trades of the century: Lacy and his partner, Van Hoisington's 40-year bet on deflation. Lacy talks about staying the course, the methodology they used to simplify their framework and what it might take for them to change tack after all this time.

Golden West: This is my favorite new podcast series on food an wine, it is hosted by Ryan Ortega. In this episode Ryan interviews Tony Biagi who has worked for many labels in the Napa Valley as a winemaker and consultant, including Neal Family Vineyards, Duckhorn, PlumpJack, CADE, Paraduxx, and more. If you enjoy wine you’ll enjoy this podcast.

CONFERENCES:

Lendit FinTech Digital: I will be joining a couple other FinTech investors to discuss my current outlook on the FinTech space and opportunities for investment. We’ll also discuss how we are adapting to online pitches and our takeaways from the pandemic. Check it out if you are free on August 26th at Noon pacific time.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch