V, U, W or L

Issue #42

Hi, I hope this note finds you doing well.

This is just a quick followup to my note earlier this week when I asked if this be a V, U, W or L shaped recovery? I got a lot of questions on what defines a V, U, W or L shaped recovery? And I think some readers were misinterpretting the L shaped recovery. So……

WHAT IS A V, U, W or L?

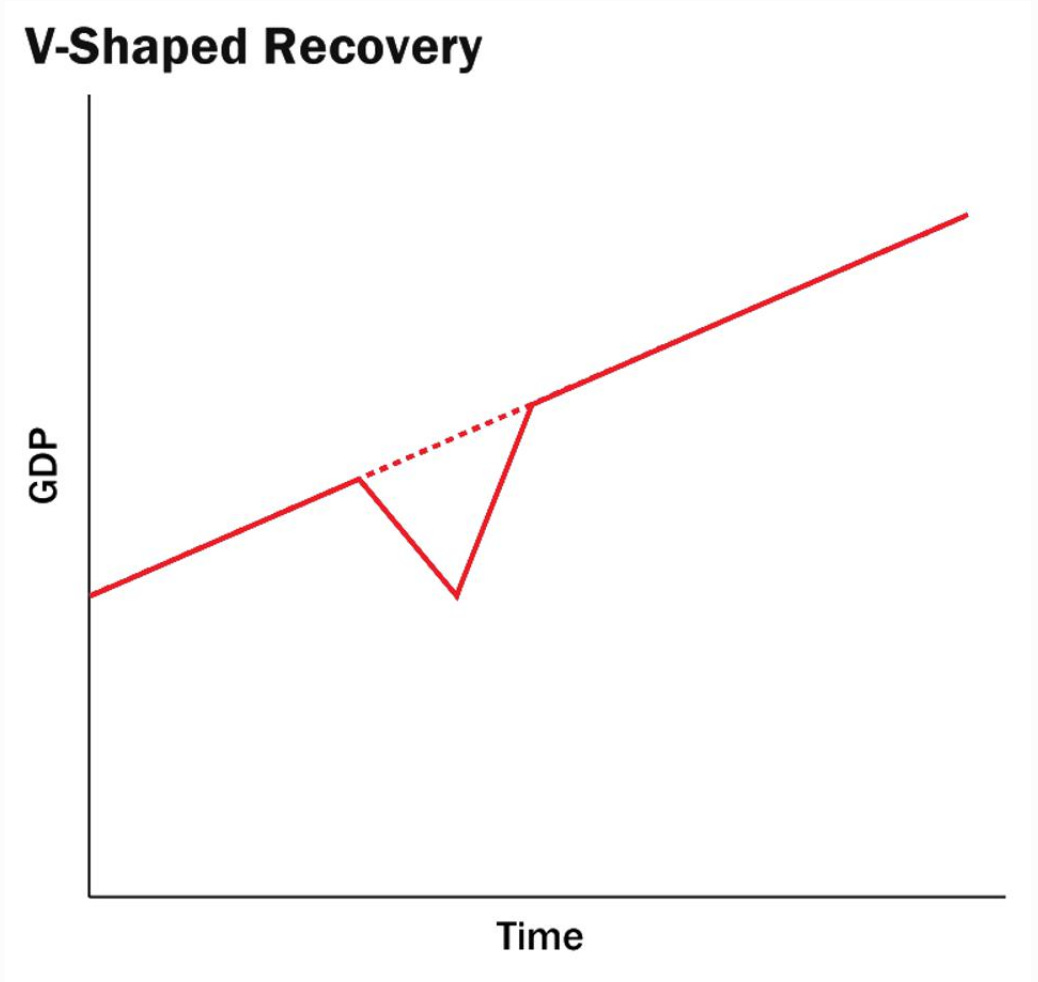

The best case scenario is a V shaped recovery, which means that the economy recovers quickly to pre-recession levels and that GDP growth continues at the same rate of as before the downturn.

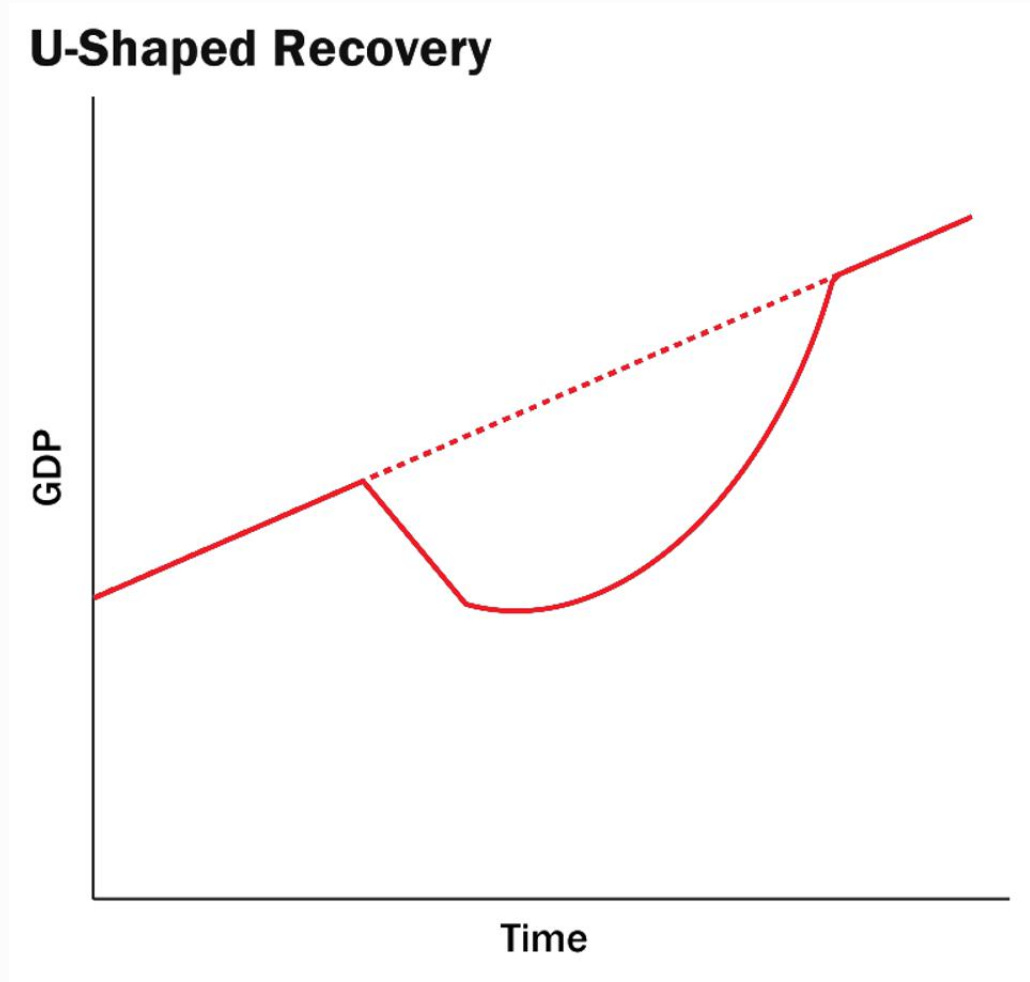

In a U shaped recovery the damage to the economy is more drawn out than in a V shaped recovery, but ultimately the economy does return to the pre-recession baseline level of growth.

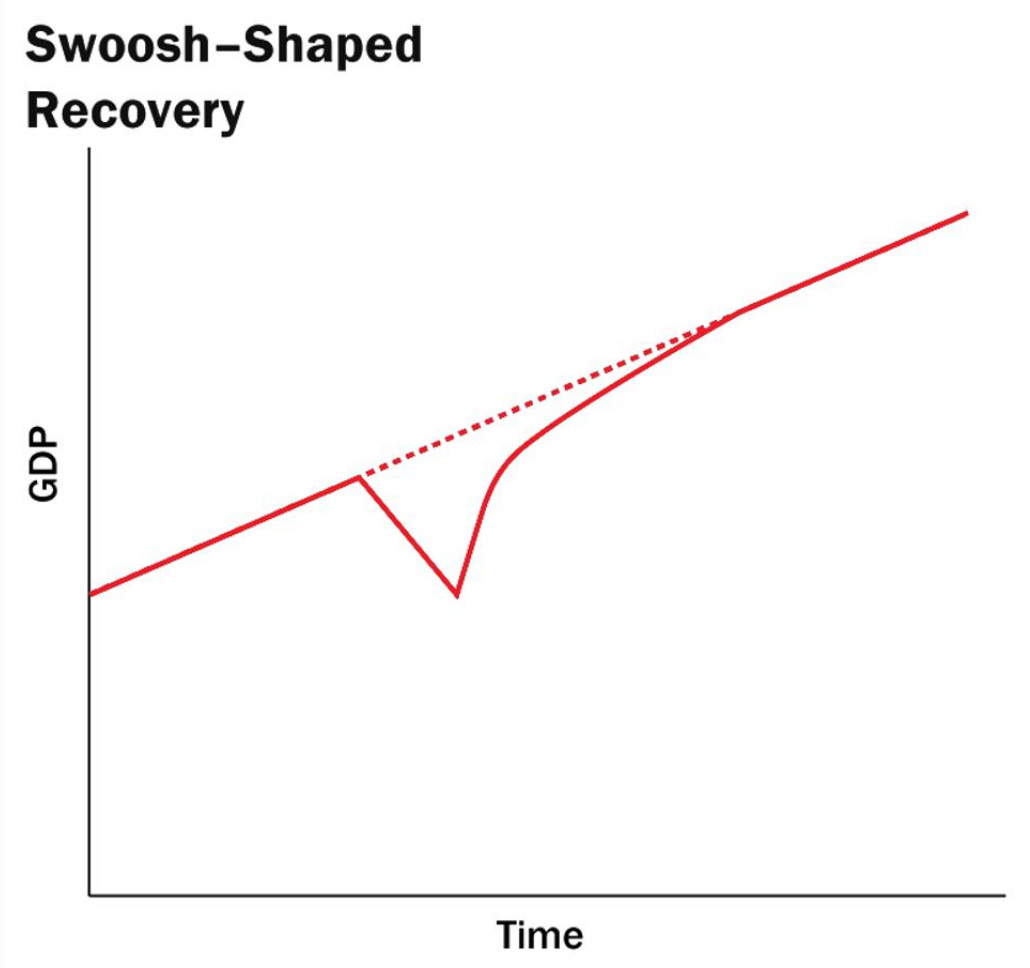

In the “swoosh” scenario there is a steep drop followed by a very gradual recovery, it takes much longer to return to pre-crisis growth levels than it took to fall into the recession.

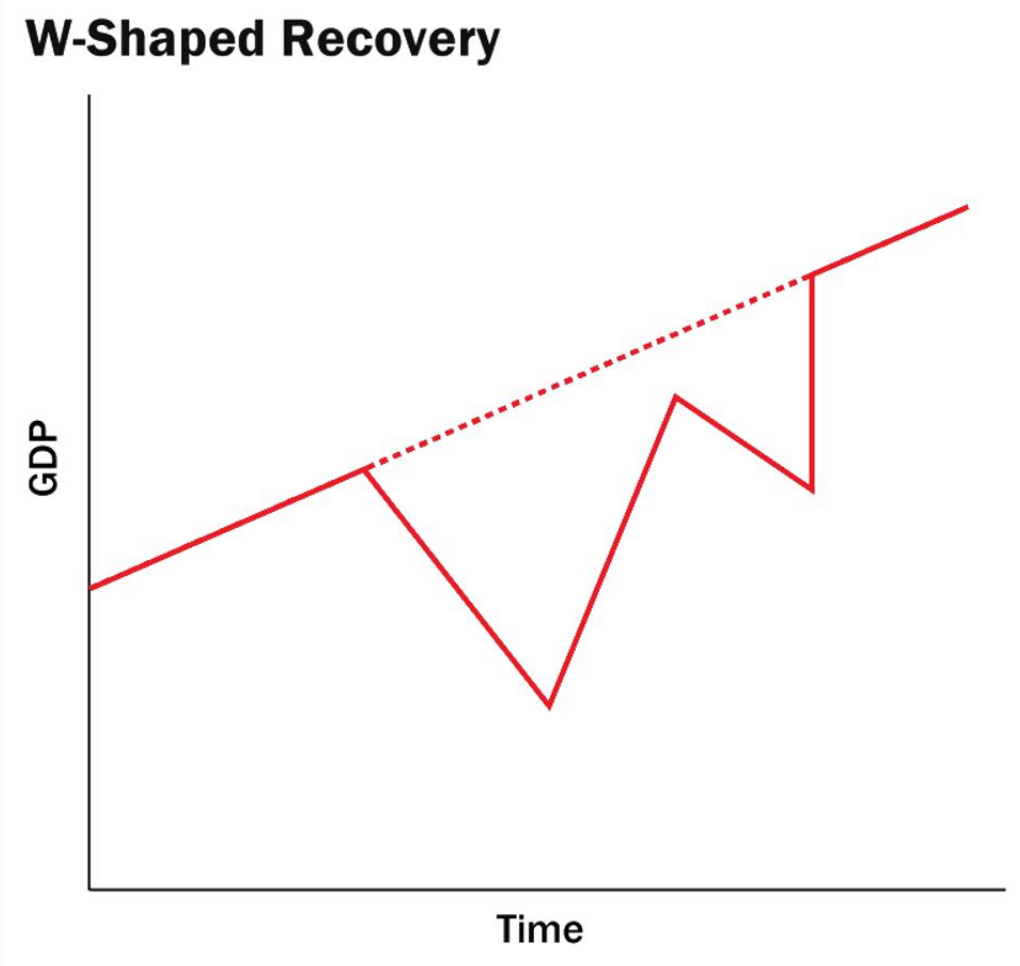

In a W shaped recovery the economy moves beyond a recession into a period of recovery before falling back into another recession. This is also known as a double dip recession. This scenario would make sense if there is a second wave of Covid-19 post recovery.

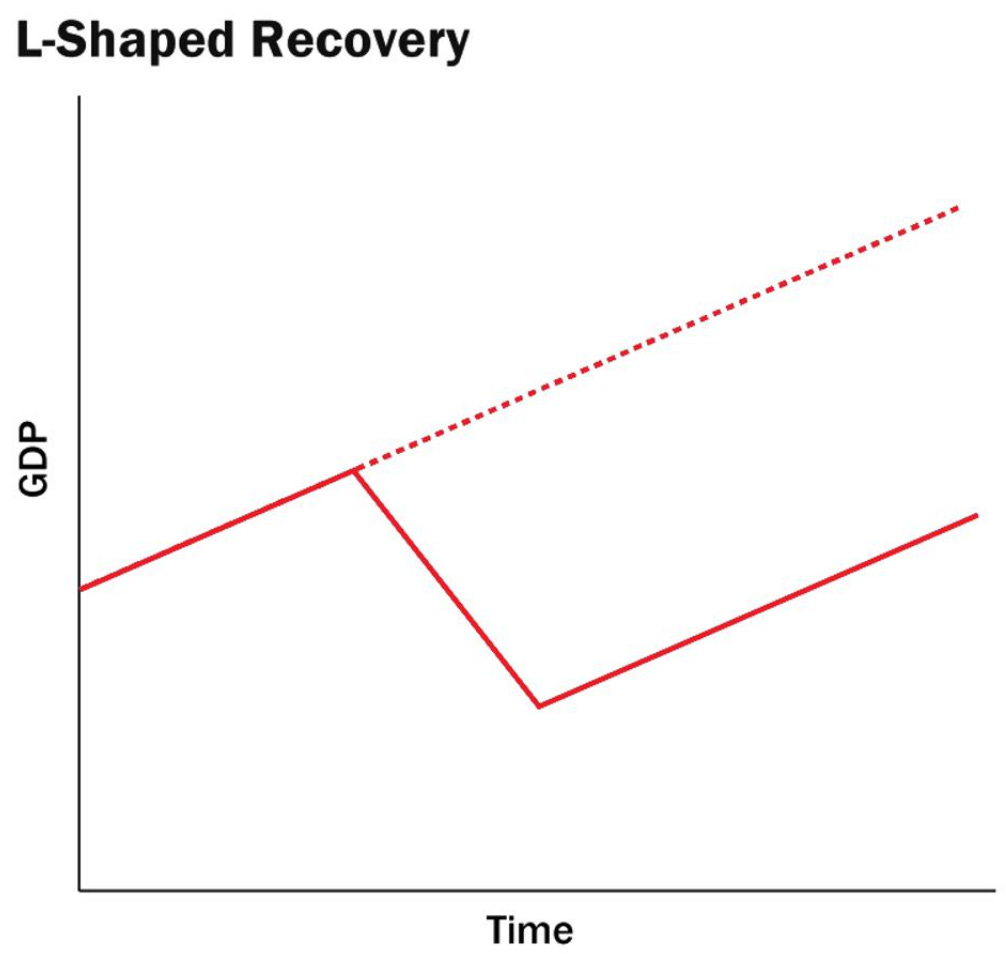

In an L-shaped recovery the economy recovers to a certain degree, but GDP potential growth does not reach pre-crisis levels for many years, if at all. This was the case following the Great Recession of 2008 when it took six years for GDP to return to 2007 levels.

Hat tip to the Brookings Institution for the above graphics! If you want to peel back the onion further, check out their story on “The ABCs of the post-covid economic recovery”. The story goes into more detail and adds a few additional scenarios.

PODCAST:

Hedged: Mark Yusko of Morgan Creek launched a new podcast called Hedged, in his first episode he interviews John Burbank and they discuss what poetry and investing have in common. I really enjoyed this podcast. Hat tip to Ryan Ortega for sharing!

Invest Like the Best: In this episode they discuss one of the biggest topics in the world of investing: the shift from public to private markets that has taken place over the last several decades. They explore the reasons for this shift, the biggest overall changes in capital markets, and what the future may hold. I thought this was very interesting. Hat tip to Sharam Honari for sharing this one!

One of the great things about writing this letter is the two way flow of information that it inspires. I learn a lot from my friends and their generous sharing of ideas, podcast and research.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch