We have all heard of “Tail Risk”, but today if you are invested you are experiencing it!

WHAT IS TAIL RISK?

As explained by Investopedia, “Tail Risk is a form of portfolio risk that arises when the possibility that an investment will move more than three standard deviations from the mean is greater than what is shown by a normal distribution. Tail risks includes events that have a very small probability of occurring, and occur at both ends of a normal distribution curve”.

Below is a graphic representing a Normal Distribution and a Fat Tail distribution.

A fat tail is a probability distribution predicts movements of three or more standard deviations more frequently than a normal distribution. Kind of feels like that is the world that we have been living in for the last several years.

Below is a snapshot from Bloomberg showing the distribution of the S&P 500 on a year to date basis. Clearly we are getting three standard deviation moves here.

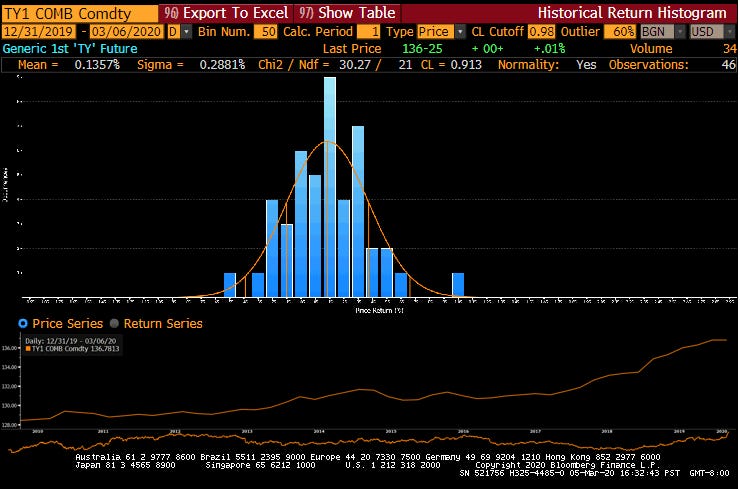

Below is a snapshot from Bloomberg showing the distribution of the 10 year Treasury Bond on a year to date basis. Clearly we are getting three standard deviation moves here too.

VOLATILITY INDEX:

Current market volatility is at levels only seen during the .com bubble, the 9/11 tragedy and the FED taper tantrum. The big spike to 60 is the Great Recession.

Perhaps it is time to think like a contrarian? Unless you think the world is about to end, in which case you should stock up on canned goods and water!

So we have 3 Standard Deviation moves in stocks and bonds that are being caused by a global pandemic, Coronavirus, that no one predicted. It is a Black Swan of sorts.

It is a good time to recap what is going on with the Coronavirus.

TRANSMISSION:

Where is the Coronavirus / Covid 19 and how bad is it?

McKinsey & Company published an article on Covid-19 Risk, it is worth reading.

From McKinsey, “COVID-19 crossed an inflection point during the week of February 24, 2020. Cases outside China exceeded those within China for the first time, with 54 countries reporting cases as of February 29. The outbreak is most concentrated in four transmission complexes—China (centered in Hubei), East Asia (centered in South Korea and Japan), the Middle East (centered in Iran), and Western Europe (centered in Italy). In total, the most-affected countries represent nearly 40 percent of the global economy”. See the table below,

WHO IS AT RISK?

The BBC put out a good piece on who is most vulnerable, you can find it here.

In short, if you are elderly and have pre-existing health conditions such as cardiovascular disease or diabetes you are at the greatest risk.

If you are under 50, you would likely recover from a run in with the Corona virus.

WHAT IS THE ECONOMIC IMPACT?

McKinsey & Company’s base-case scenario calls for a quick recovery, it assumes the continued spread within established complexes, as well as community transmission in new complexes (see option 1 in the table below).

With the above baseline assumptions, McKinsey expects a 0.3- to 0.7-percentage-point reduction in global GDP growth for 2020. Not quite the Doomsday scenario that many in the media are peddling to keep viewers tuned in….

BEHAVIORAL ECONOMICS and REFLEXIVITY:

The Research Affiliates article, Oh, what's this stuff really worth? had a quote that caught my eye, “the creation and spread of an unsettling narrative (Shiller, 2019) could precipitate a self-fulfilling crisis (Merton, 1948)”.

Seems pretty relevant to today.

In short, Robert Shiller believes that economic facts are often driven by our feelings. Those feelings are in turn driven by what he describes as economic narratives—contagious stories with the potential to change how people make economic decisions.

Shiller speculates that “ultimately, the mass of people whose decisions cause economic fluctuations aren’t always very well-informed…and yet their decisions drive aggregate economic activity. It must be the case that attention-getting narratives drive those decisions.”

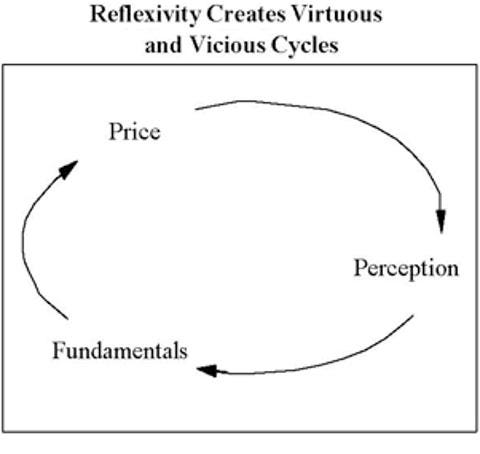

This dovetails nicely with George Soros: General Theory of Reflexivity.

From Investopedia, “Reflexivity is a theory that positive feedback loops between expectations and economic fundamentals can cause price trends that substantially and persistently deviate from equilibrium prices”.

ARTICLES and PODCAST:

BBC: Corona Virus - How To Protect Yourself

Center for Disease Control and Prevention: General Information on Coronavirus

New York Times: Coronavirus Updates and Full Coverage

Mayo Clinic Talks: Coronavirus (10 min Podcast)

CONFERENCES:

I’ll be at the following conferences, if you are too, let me know and we’ll circle up!

March 6-8 - Lake Tahoe California for the Squaw Valley FinTech Symposium.

March 18 - San Francisco Marine’s Memorial Club for the 5th Annual West Institutional Real Estate Investor Forum 2020 where I will be on a panel covering the role of Real Estate in an international institutional portfolio

April 2-3 - Los Angeles California for the ALTSLA2020 conference; I’ll be on the Venture Capital / Angel Investor panel.

April 14-15 - San Francisco California for the Pension Bridge conference.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my syndicate here; I am currently syndicating a digital bank, Sable, that serves recent immigrants to the United States.

Have a great weekend!

- Sean Bill / MacroCrunch