Hi All,

I am in New York this week and I will say that the City seems to be back in full force. There are several conferences going on simultaneously, investors are coming in from all over the country and restaurants are full.

It seems like people are ready to do business again.

INFLATION

Yesterday we saw a modestly higher print in the inflation numbers, which sent the markets into a bit of a tailspin, no surprise there. In short, consumer prices moderated less than forecast in August, rising 8.3% year on year (estimates were for 8.1%).

This has shifted the conversation to the possibility of a 100 basis point hike!

For historical context, the last time the FED hiked rates 75 basis points prior to the current cycle was November 15, 1994. And if memory serves, there were only three 75 basis point hikes in the history of the FED prior to the current cycle.

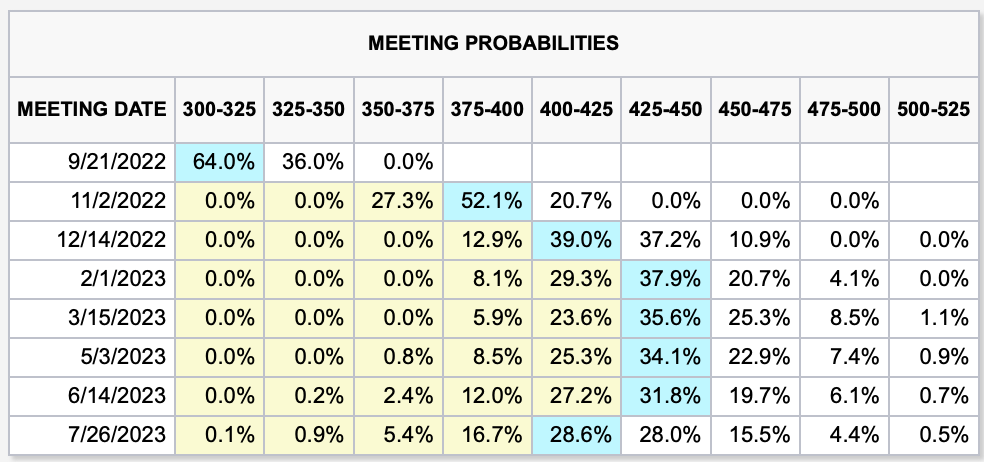

But, as you can see in the chart above, courtesy of the CME, the market is now pricing in a 38% chance of a 100 basis point hike. That is a bit disturbing and the idea of a one in three chance of a 100 basis point rate increase is cannot to be dismissed.

That said, my money is on a continuation of the Summer of 75….

CONFERENCES | TRAVEL

SALT NEW YORK 2022: September 12 - 14, I am in New York attending the SALT Conference, which has been fantastic. It has been great to connect with old friends and to meet new friends.

JAMES ALPHA MANAGEMENT: September 15, I will be in New York to moderate a breakfast round table discussion on digital assets hosted by James Alpha Management. I am looking forward to hearing how managers are approaching the digital assets markets given the recent volatility and their outlooks for 2023.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter