STIMULUS & CREDIT

Issue # 39

I hope that this note finds you in good health and spirit. Here in California we are experiencing rolling blackouts, internet outages, a homeless crisis and air filled with thick smoke from raging forest fires.

I think we are definitely ready to say goodbye to 2020!

STIMULUS:

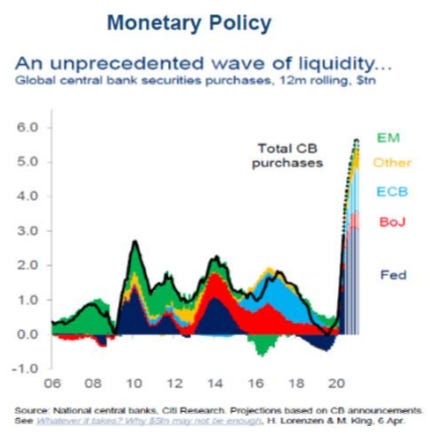

We have covered monetary policy stimulus in depth on this blog, but to recap central banks have issued over $12 trillion in fiscal stimulus to date and it doesn’t look like the central bankers will be taking their foot off the gas anytime soon.

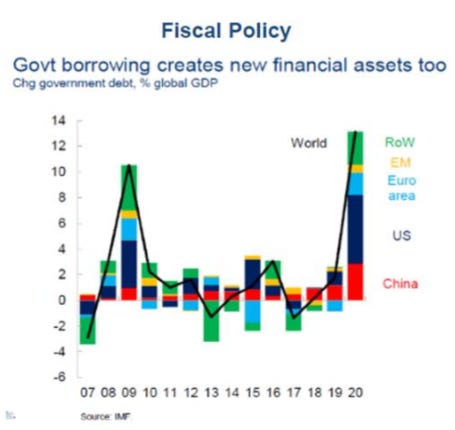

Across the world, we see similarly unprecedented levels of fiscal stimulus, with the highest level in Italy where the stimulus as a percentage of GDP is 53.3%. In Germany, it’s 49.5%.

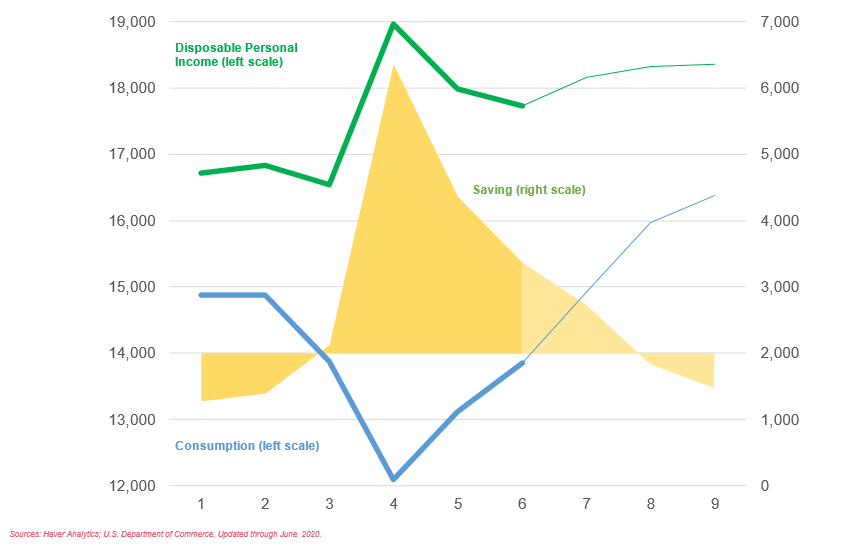

In the United States the monetary and fiscal stimulus represents 29.5% of GDP. Fiscal programs, such as the now expired extra $600 per week for the unemployed actually increased disposable income and the savings rate! Who would have thought?

The consumer is managing their way through the pandemic and the government programs have likely helped avoid a full blown depression.

CREDIT:

Corporate America has been the benificiarry of aggressive government programs too. This is most clearly seen in the support of the credit markets by the Treasury and the Federal Reserve.

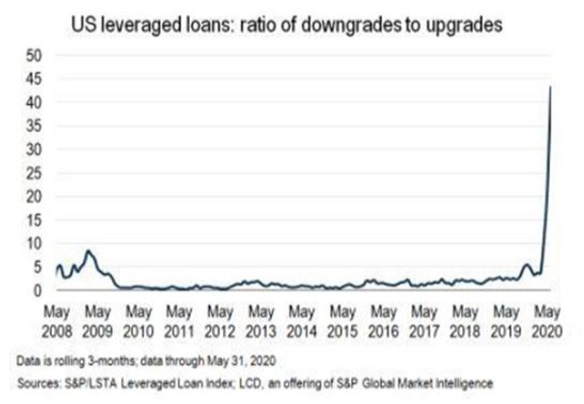

But look below the surface and you will see cracks in the system. Look no further than the level of ratings downgrades to upgrades – recent downgrades are 43 times the level of upgrades! That compares to a ratio of 8.4 times in the GFC.

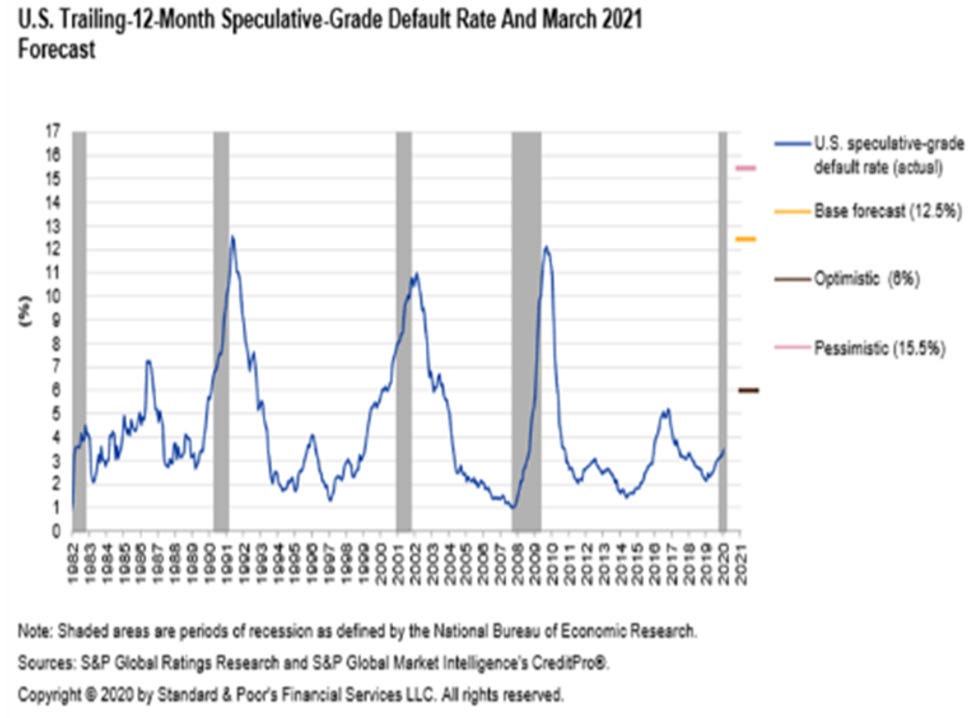

Defaults in the high yield market have increased to 3.5%. Standard & Poors projects annual defaults will reach 12.5% in the base case and could reach 15.5% in their worste case scenario. Personally I think that is overly pessimistic, but I do think we will see defaults reach 6-8%.

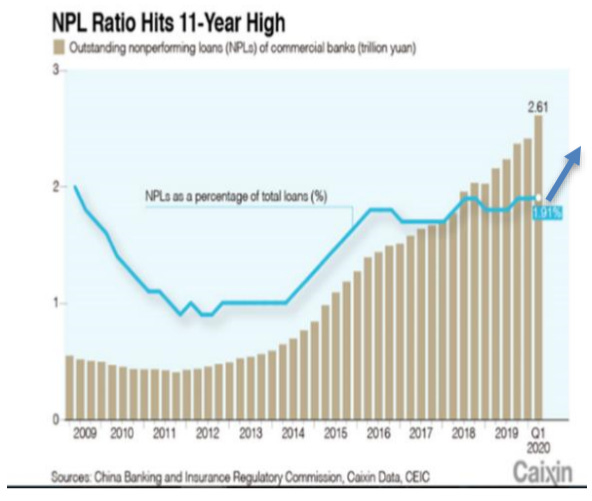

And China is also seeing an uptick in delinquent credit.

Non performing loans have hit a record high and look as though they will continue to increase. We don’t know what the real number is, but the trend is clearly going from the bottom left to the top right.

PODCAST:

CIO Conversations: Betty Salanic interviews Marcus Frampton, CIO of Alaska Permanent Fund Corporation, a $60 billion sovereign wealth fund. Marcus shares his investment philosophy, top reasons why APF does not invest in a fund manager, and his thoughts on investing in private equity and ESG.

Hat tip to Ryan Ortega for finding this one!

CONFERENCES:

Thursday August 26th at Noon PDT I will be participating in the LendIt Fintech DIGITAL conference where we will be discussing early stage investment opportunities in Fintech with Kathleen Utecht and Phin Upham of Core Ventures and Haymaker Capital respectively. Join us if you are free.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch