Hi All,

It has been a while since I have had time to Blog, I’ve been super busy with managing our angel investments and private credit funds. The collapse of Silvergate and the Silicon Valley Bank in March happened really fast and didn’t allow for any distractions until the FDIC decided to bail out depositors… which I am glad that they did!

If you want a great rundown on the 2023 banking crisis check out the Blockworks podcast below or read Jesse Austin Campbell's substack article on "How Banks Fail", both are solid explanations of what happened.

VENTURE CAPITAL

If you follow my syndicate FinTech Angels or are an investor in my fund ReCurve Ventures you know that I did not deploy much capital into Angel deals in 2022, I felt that the valuations were ridiculously high and as a result I sat on the sidelines for most of the year. So far 2023 has been no different, I have not funded a single deal this year in spite of hearing a ton of pitches.

I do think that pre-money valuations have recently peaked and are beginning to show signs of rolling over, but it is still very early. I expect that valuation levels will continue to decline for early stage VC through 2023.

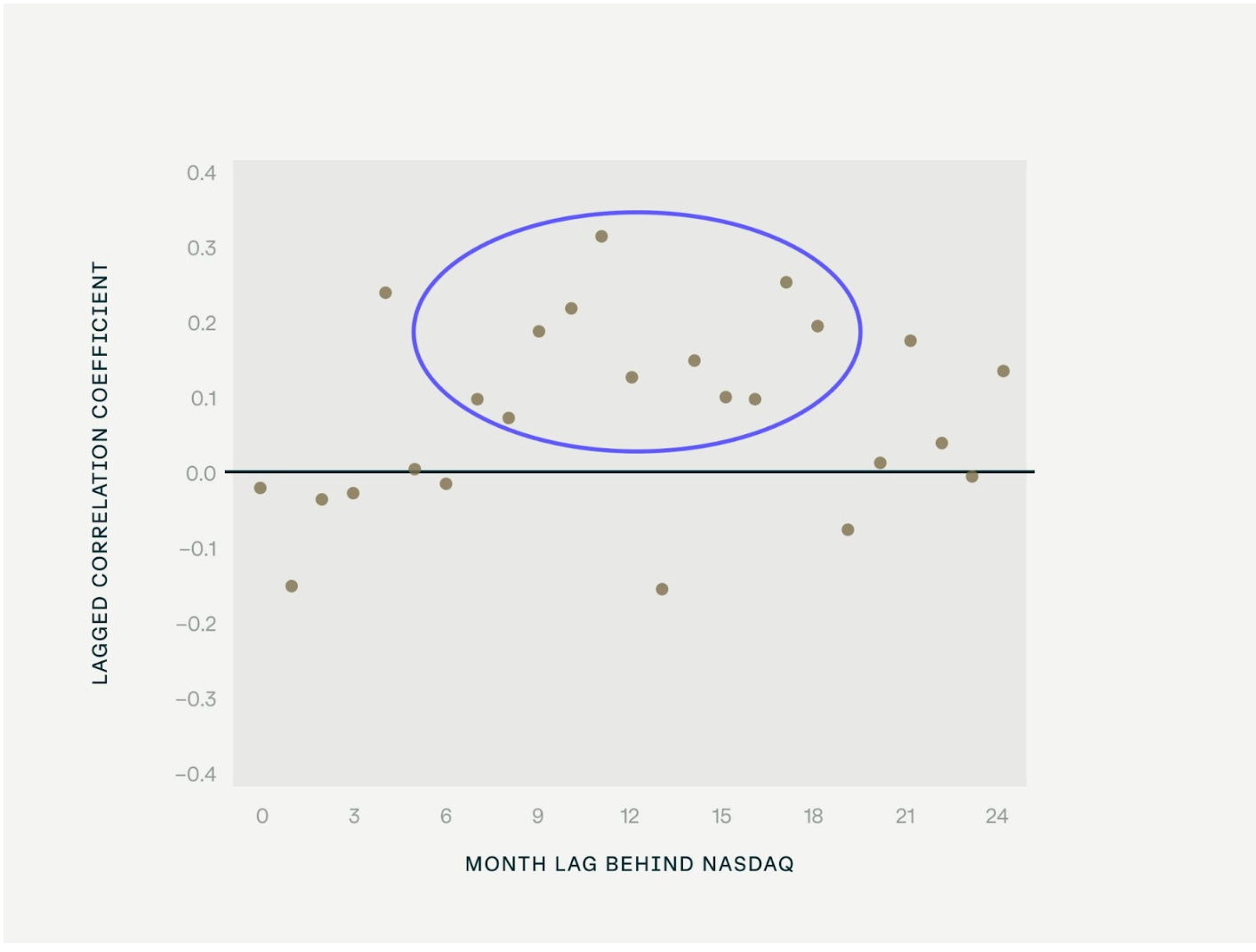

AngelList’s data for the first quarter of 2023 indicates that early-stage venture is not out of the woods yet. Their recent blog post on lagged market correlations suggests it takes 9-18 months for changes in the public markets to trickle their way down to the private markets. The chart below is simple index of every seed-stage investment on the AngelList platform that is 1+ years old, looking at its changes in value against the tech-heavy Nasdaq index with a 0 - 24 month lag.

With the NASDAQ index peaking in November of 2021, I would expect that valuations will not hit bottom until the second half of 2023 at the earliest. This makes sense as most startups raise enough capital to maintain a runway of at least 18 - 24 months before they need to go back to the market for additional funding.

Pre-seed and seed stage valuations still seem rich, but it also seems like pre-seed is what we used to consider as seed and seed is what we used to consider as Series A rounds. So there is some subjectivity involved in categorization, see the valuation data below for Q1 2023 courtesy of AngelList.

As a syndicate and Fund that focuses on FinTech, GovTech and AI/ML startups I do feel that we are very well positioned to deploy capital as we have avoided getting sucked into overpriced rounds and will likely have an opportunity to participate in bridge rounds at sharply lower valuations in the second half of 2023 and 2024.

An interesting insight from AngelList, “despite capturing the second highest share of deal volume, the AI / ML sector had only the sixth-highest share of capital deployed in 1Q23—after fintech, healthtech, aerospace, Web3, and security, respectively. This could suggest AI projects aren’t as capital intensive as startups in other sectors like aerospace”.

I think that the above point is absolutely correct, AI / ML is software driven and a startup in this space can maintain a very light footprint as it seeks to find product market fit. Check out my blog post from last year on AI's iPhone Moment for more on that. Again, I think that this very much favors the syndicate and Fund strategy which is to deploy $100,000 - $250,000 investments per startup, that smaller check size keeps us in the conversation for startups that may only seek to raise $2 - $3 million.

Those are my thoughts on the current state of valuations in the early stage VC space.

PODCAST / VIDEOS:

Blockworks SVB Collapse Explained: Mark Yusko and Mike Polito discuss the collapse of Silvergate and Silicon Valley Bank. They walk through the dynamics that led to depositors running for the exit doors in typical bank run style fashion that was accelerated by Twitter and digital access to deposits.

AngelList The State of Early Stage Venture Capital 2022 Review: If you are interested in early stage venture capital investing, this is a great recap of 2022 as shown by the Data that Angel List and SVB parse out. A lot of interesting information on valuations, up rounds vs. down rounds and lead / lagging sectors.

CONFERENCES:

West Coast Tour: April 17-20, 2023: April 17 - 20, Seattle, SF and Palo Alto - Great conference for SFO / MFOs to swap info on managers that they are investing in today. I will be on a venture capital and private credit panel with a focus on FinTech.

SACRS Annual Spring Conference 2023: May 9 - 12, San Diego - This is my favorite conference of the year as it is a great opportunity to hear from many of the top investment managers on their outlook for markets and how they are positioning.

SuperReturn International Private Debt Summit: June 5 - 9, Berlin - This is a great event to meet other investors and managers focused on the private debt sector. This will be my first time at this conference, so if you have any tips send them my way!

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter