Stan's the Man!

Issue # 57

MARKETS:

Pretty interesting week in the markets….. BIG TECH definitely got clobbered, in spite of generally positive growth in earnings and revenues.

For example, Tesla was down almost 14% in spite of record revenues and net profits. Guidance on car production looked solid at 780,000 + units for the year with two new factories scheduled to come online in Texas and Germany by year end.

So what was all of the fuss about?

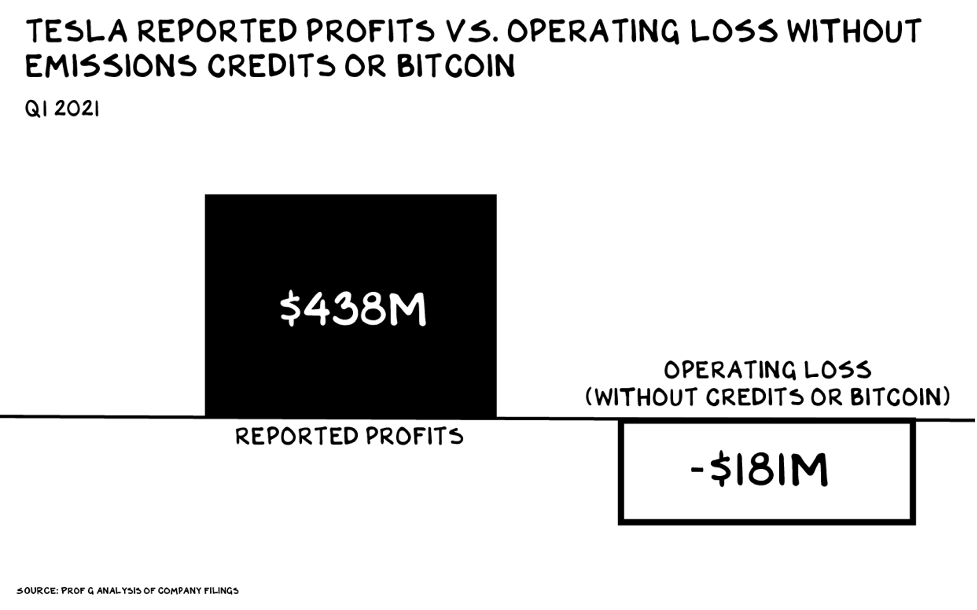

The only thing that I could find is that when you peel back the onion on Tesla’s earnings, energy credits and profits from Bitcoin sales seem to be responsible for moving the car company into the black for the quarter (see below). Earnings credits are part of the business model and are expected to continue to grow, but gains from Bitcoin may be viewed negatively by Wall Street as they are less certain or predictable.

Stepping away from BIG TECH, the broad averages had only a modest move down. Market pundits are focused on potential inflation, long gas lines and unrest in the Middle East. As I read that, I am thinking of the Carter years…..

IS THE DOLLAR GOING DOWN?:

Last week I touched on the US Dollar and its status as the Reserve currency of the world. Being the Reserve currency of the world has many benefits such as being able to run large current account and budget deficits as the demand for Dollars outside the United States remains very high.

But, we should not take our status as the reserve currency for granted. A better alternative could arise and displace the Dollar. The Federal Reserve, Treasury and many Politicians have learned that we can plaster over our problems by printing money for massive fiscal and quantitative easing programs.

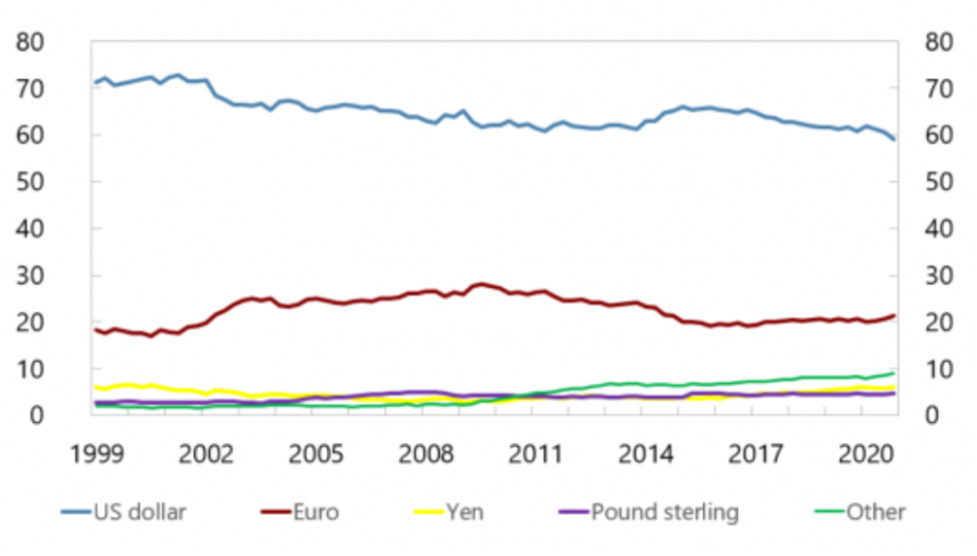

The status if the US Dollar is in decline, representing less than 60 percent of foreign central bank reserves according to the IMF (see below).

In an interview on CNBC investing magnate Stanley Druckenmiller claims the Fed’s attempts to sustain the economy during the pandemic could threaten the US dollar’s long-term health and its status as the Reserve currency of the world.

Druckenmiller said:

I can’t find any period in history where monetary and fiscal policy were this out of step with the economic circumstances, not one…. If they want to do all this and risk our reserve currency status, risk an asset bubble blowing up, so be it. But I think we ought to at least have a conversation about it.

In the video below Druckenmiller says central banks are the root of dollar instability.

ARTIFICIAL INTELLIGENCE:

Who wants to stand in line at the checkout?

Last week I had a chance to join a bunch of fellow SEP alumni from the Stanford GSB to visit online with the founders of a company called AiFi. The company is transforming retail shopping into an autonomous experience. Check in when you arrive, shop and leave the store without the need to stand in line at the cashier.

This is the future, it is just a question of how soon it arrives. Check out the video here.

Hat tip to Dan Matthies of Reaction Global for reminding me to jump on this Zoom call!

PODCAST:

The Economist Money Talks: Does The World Still Need Banks?

Technological change is upending finance as the clout of payment platforms and tech firms grow and central banks begin to issue their own digital currencies. But can you imagine a world without banks?

Rachana Shanbhogue explores the future of banking with Alice Fulwood, The Economist’s Wall Street correspondent, Jamie Dimon, CEO of JPMorgan Chase, Patrick Collison, co-founder and CEO of Stripe, Kahina van Dyke, head of digital and data at Standard Chartered, and Jean-Pierre Landau, former deputy-governor of the Banque de France.

I hope that you enjoy the letter as much as I enjoyed making it and please feel free to share the links with friends and associates and if you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. Sean Bill / MacroCrunch / Twitter