I hope that you had a great Memorial Day weekend!

I also want to express my sincere appreciation to the hundreds of people who left messages, sent emails and texts in response to the mass shooting that occurred last week at the Santa Clara Valley Transportation Authority. I have not had a chance to respond to everyone, but thank you all for expressing your concerns and for keeping the VTA in your thoughts and prayers.

If you would like to support the victims of gun violence and of this horrible tragedy, please consider making a tax deductible donation to the VTA Solidarity Fund.

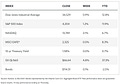

MARKETS:

The S&P 500 eked out a small gain in May, its fourth consecutive monthly rise. The narrative remains unchanged, central banks continue quantitative easing programs and governments continue massive fiscal stimulus programs.

Financial asset inflation continues unabated.

Central bank policies are making it punitive for savers to own bonds. The chart below, 10 year bond yields minus CPI, illustrates that you are losing purchasing power on a real yield basis if you own sovereign debt. We have seen a steady decline in allocations to fixed income by institutional investors for a decade. The role of sovereign fixed income exposure has been relegated to serving as a ballast to equity risk premium being embraced elsewhere in the portfolio.

CORPORATE EARNINGS:

Corporate earnings are up 50% versus a year ago with 97% of the S&P 500 companies having reported. This is the fastest pace of earnings growth since 2010. Approximately 86% of companies have topped analyst projections, with actual results exceeding analyst expectations by a record 23%.

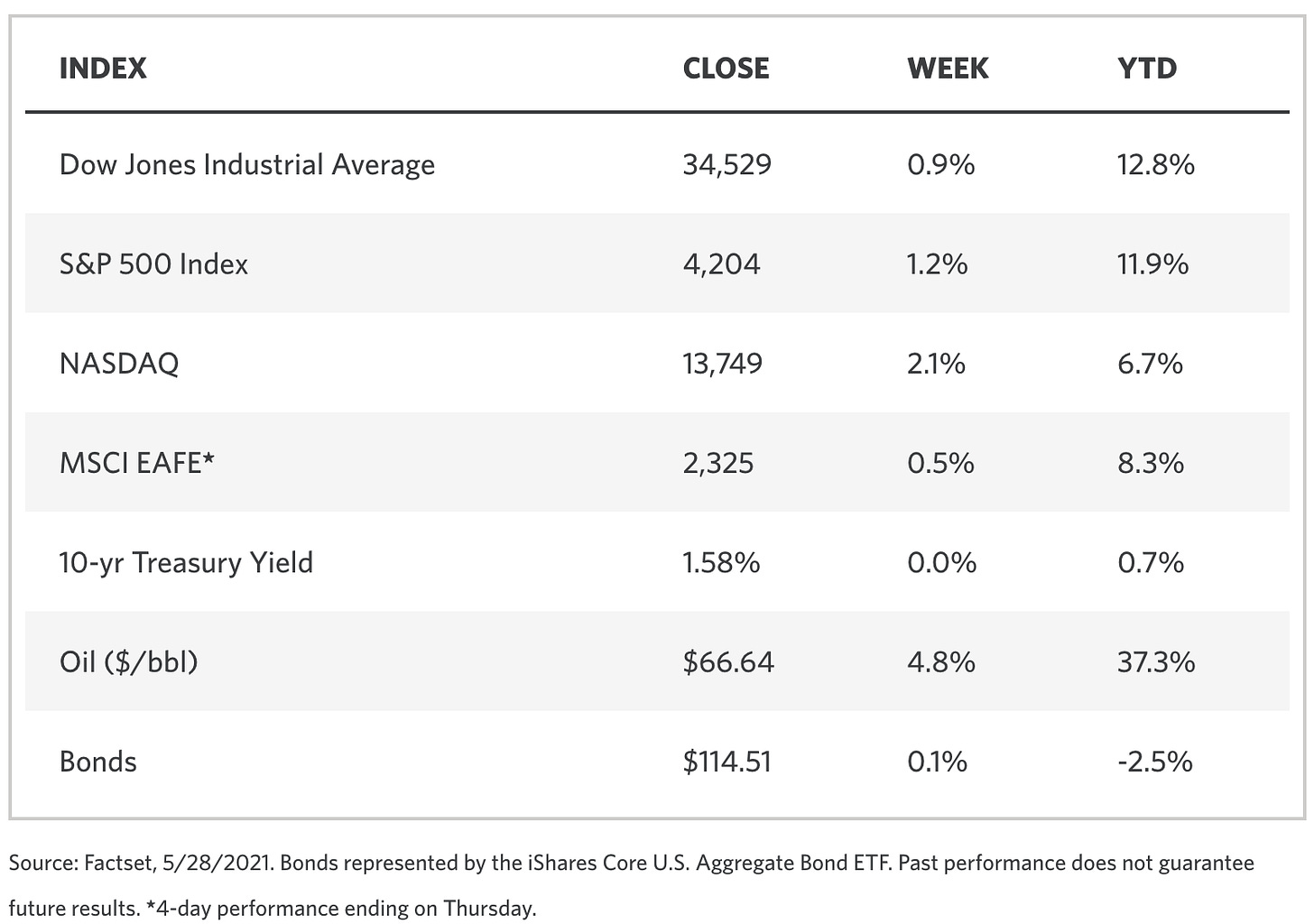

Corporate profit margins have also reached record highs at 13.1% (cart below). The consumer discretionary (led by automakers), financials (led by banks) and materials sectors experienced the largest gains.

Corporate America is lean and mean and ready to get back to work.

FUTURE EARNINGS:

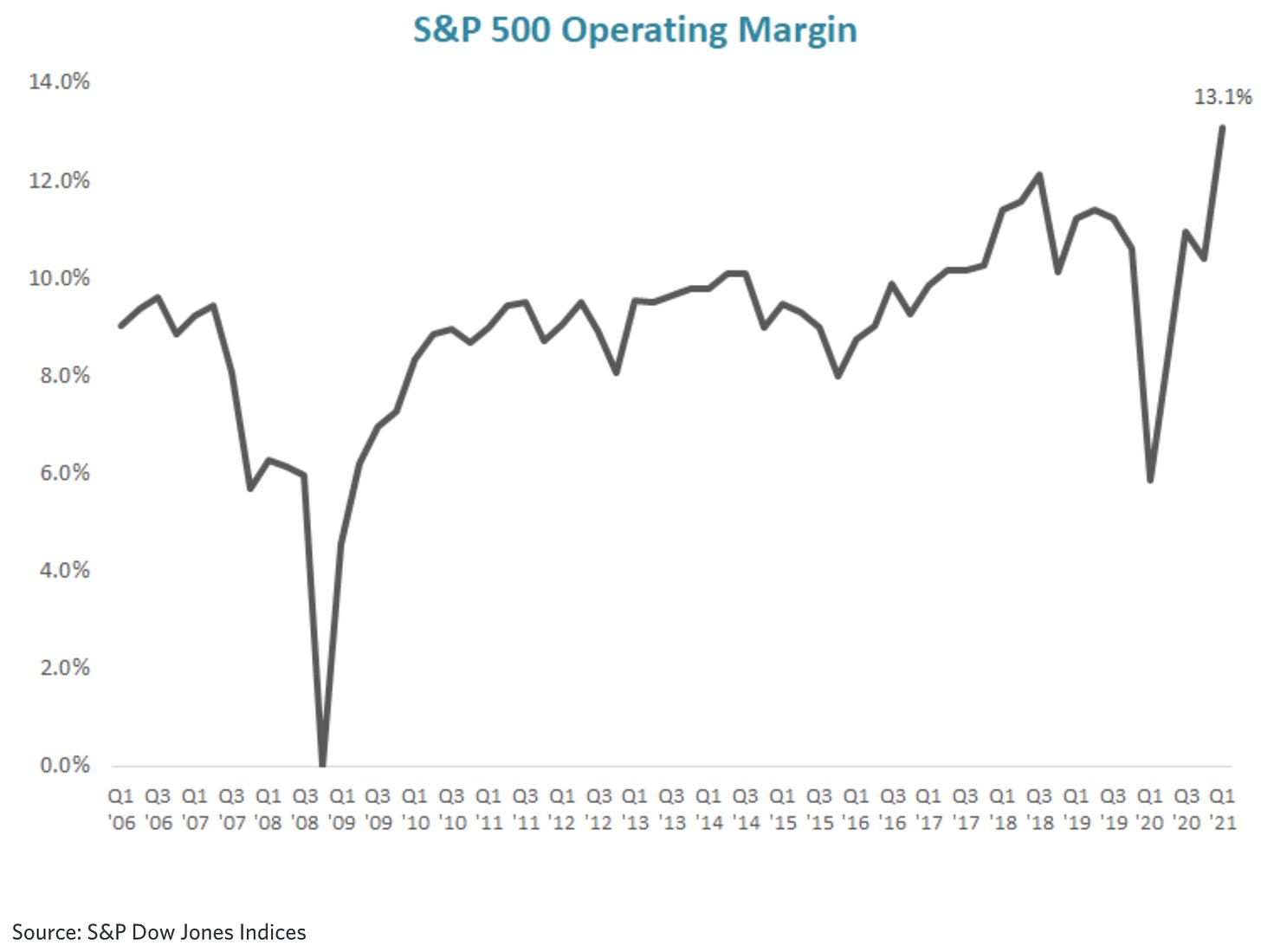

What’s priced in and how do forward projected earnings compare to the past?

Currently, forward looking 12-month corporate earnings are expected to exceed pre-pandemic levels by +11%. The graph below would suggest that there is much more upside if we extend our horizon beyond the next 12 months.

Following the last two recessions, corporate earnings continued to grow by an average of 65% once they reclaimed their previous peak (chart below). Considering the levels of central bank and government interventions and the resulting increased consumer savings, it is not hard to imagine that this recovery may in fact be stronger than anything we have witnessed in the past. Note the steepness of this recovery versus the prior two recoveries in 2002 and 2009; we could go hyperbolic as pent up demand is released.

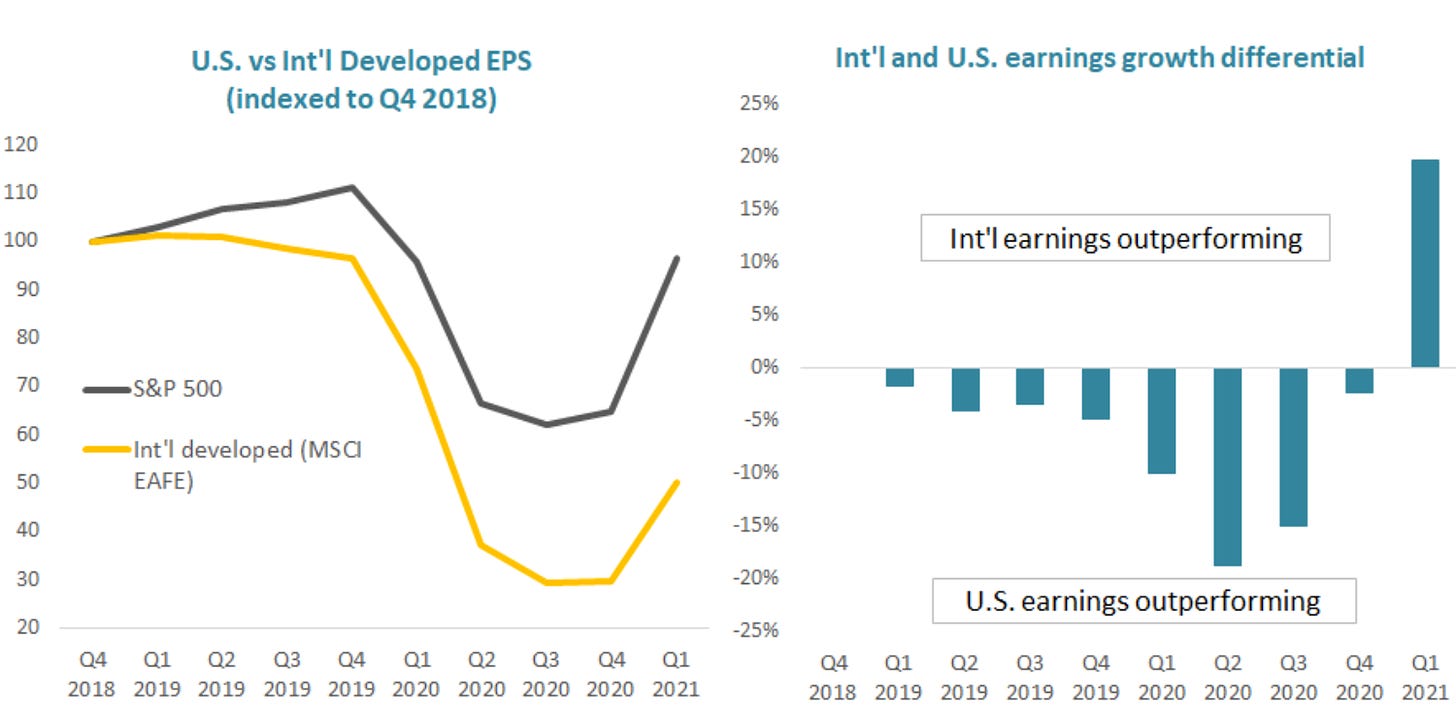

USA vs. WORLD:

May was the first month this year that international developed large-cap stocks outperformed U.S. large-cap stocks. In fact, international earnings growth outpaced U.S. earnings growth by 20%, the first relative quarterly out-performance in 3 years. The sector makeup of international developed indexes, specifically the larger weight in cyclical sectors, would argue for further potential relative out-performance ahead if the global pandemic is indeed behind us.

Since the 2009 GFC I have been told that international developed markets are cheap on a relative basis to the United States, and for that entire time that has remained the case. I think that the differences in the relative valuations are primarily a function of and in fact are justified by the regulatory, tax and legal structure differences between the United States and other developed countries. The culture of innovation also plays a very big part in the relative value between the USA and the rest of the World.

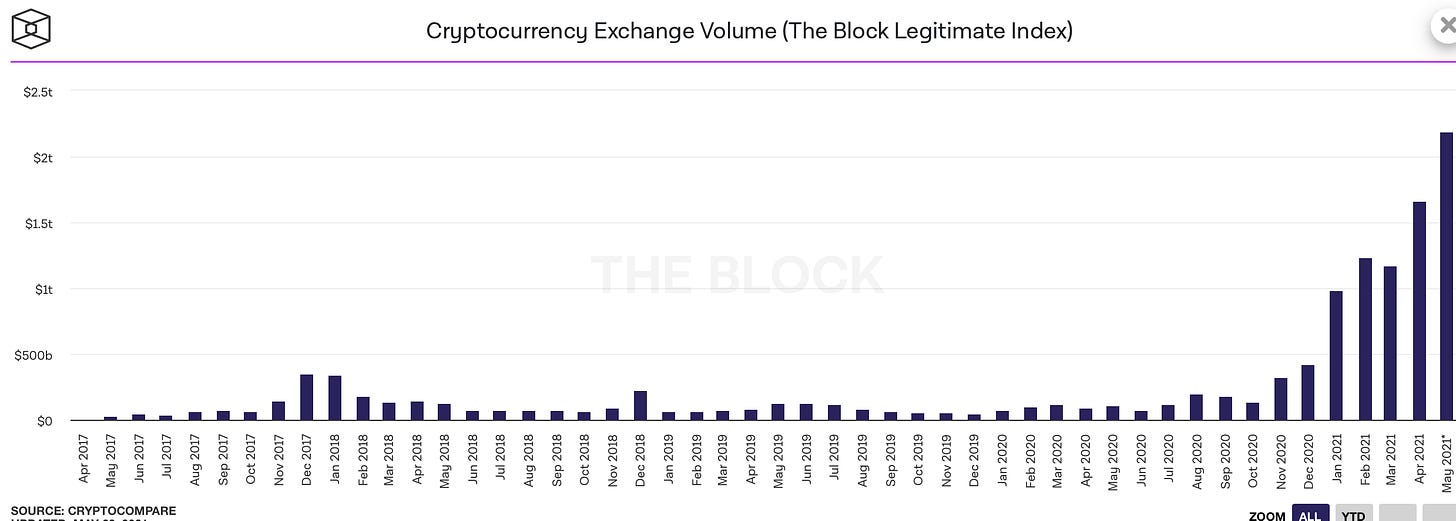

CHART OF THE WEEK:

Charts like the one below make it hard to dismiss digital assets and crypto currencies as a viable investment category. When I saw this chart I was blown away by the growth in crypto currency trading, going from less than $500 billion a month in December 2020 to over $2 trillion a month in May 2021.

I am focussing a lot of my time on digital assets and decentralized protocols. If you see something that you think is amazing and you are investing your own money in it, let me know and I may join you. I really think that DeFi is just getting started and that the opportunities for capital appreciation will be massive.

PODCAST:

MacroCrunch - Artificial Intelligence and Investing: Artificial Intelligence is on the rise. If it takes on such functions as executing trades and picking securities, what are the benefits and the costs? Will there be a human toll? What are the benefits and innovations we expect from AI in the near future? In this episode Sean Bill discusses these and other topics with Maggie Ralbovsky, Managing Director at Wilshire Associates, Dr. Ashby Monk, Executive Director at the Stanford Global Projects Center, and Alex Stimpson Chief Investment Officer at Corient Capital Partners.

Planet Money - One Hack To Fool Them All: This is a great podcast that explains the Solar Winds hack in 20 minutes. The Solar Winds hack enabled hackers to go deep inside the networks of the biggest corporations in the world and deep inside the United States government itself. This is well worth your time!

I hope that you enjoy the letter as much as I enjoyed making it and please feel free to share the links with friends and associates and if you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. Sean Bill / MacroCrunch / Twitter