MARKETS, RENT & WFH....

Issue # 34

Hi,

I hope this note finds you healthy and safe. Be sure to wear your mask!

MARKETS:

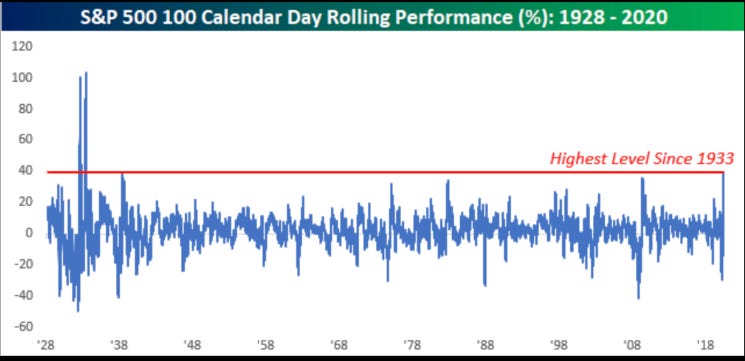

Since bottoming on March 23, the S&P 500 has rallied 40%, a performance that has not been seen for almost nine decades. The S&P 500 had previously recorded only five 100-day rallies of at least 33% in its history, according to the Bespoke Investment Group.

Three of those rallies occurred before the second World War, the other two took place in 1982 and 2009. In each instance, the index fell the following week, but was higher three months later. It was up an average of 7.3% after six months, and 13% after a year.

Not suprising when you take into consideration the amount of liquidity being injected into markets by the BOJ, ECB, FED and PBOC.

HOUSING / RENT:

Yesterday I saw a story on Bloomberg which confirmed my suspicion that rents are dropping all across the Bay Area. San Francisco is still the most expensive rental market in the United States, with the median 1 bedroom renting for $3,280 per month. But as you can see from the chart below, rents are dropping fast.

Why? See below…..

WORK FROM HOME (WFH):

I haven’t seen the hard data yet to confirm it, but it looks like those who can work remotely indefinitely are choosing to relocate out of expensive cities for cheaper suburbs and in some cases out of the state entirely.

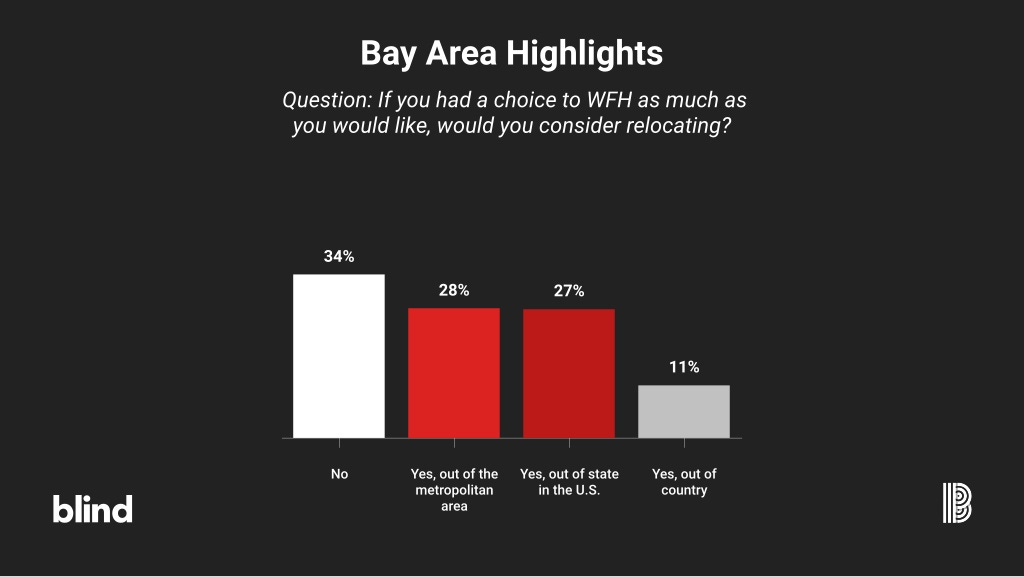

As I was looking into this I stumbled across a survey from Blind that shows 28% of 4,400 tech workers surveyed plan to leave the Bay Area and 27% plan to leave the state. The latter is bad news for the state as these are some of our most productive citizens.

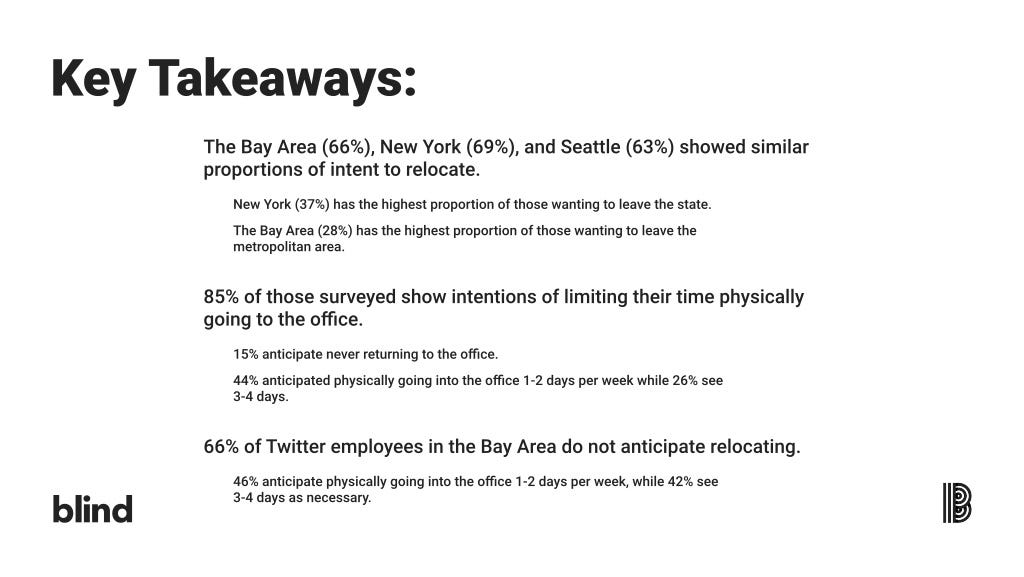

For those that plan to stay in the Bay Area, the way they work has changed forever. Approximately 46% said that they plan to return to work 1-2 days per week, while 26% said they would return to work 3-4 days per week. Only 14% plan to return to the office full time. See the chart below, also from Blind.

The results are similar for New York and Seattle. Below is a summary of the Blind survey.

PODCAST:

Real Vision with Hugh Hendry: I first met Hugh Hendry when my old friend Steve Drobny introduced us back in 2004, I haven’t seen Hugh in at least 3 years, the last time was to have dinner in San Francisco. So I was pleasantly suprised when he resurfaced in Saint Barths. He is eccentric and brilliant, I think his take on the “Gilded Depression” is spot on.

Real Vision with Bill Tai: This is probably the most interesting youtube video I saw this week, it was featured as part of RealVisions online Crypto Festival (more on that later). Bill talks about waves of innovation and where we are now, it was super interesting.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch