LEHMAN or ENRON?

ISSUE # 83

Hi All,

I hope that you had a nice weekend. I spent a fair amount of time digging into the FTX bankruptcy. For those of you who don’t know, FTX runs an offshore and an onshore exchange and it’s founder Sam Bankman-Fried also ran a hedge fund called Alameda Research.

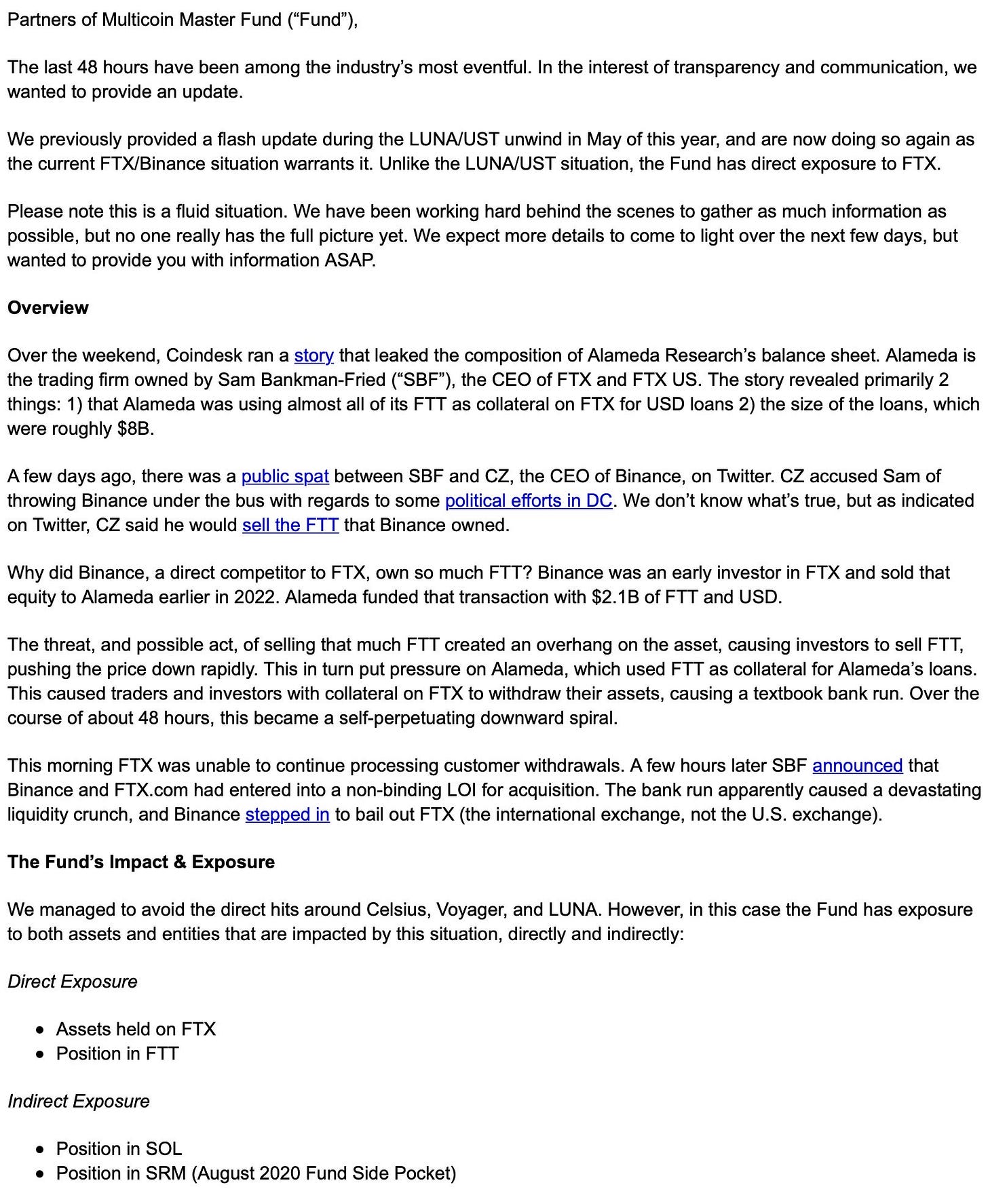

I read a lot, but I think that the snippet below via Twitter from Multicoin sums up the situations pretty succinctly.

Later in the week Binance backed out of the agreement to bail out FTX citing its due diligence did not allow them to move forward. That was the end of FTX as we know it. I think that it will be very unlikely that anyone will step in to plug a $9 billion USD debit, and it is doubtful that the brand itself holds much value post the collapse.

MISMANAGEMENT or FRAUD?:

The BIG question is, is this a Lehman or Enron scenario? Was the collapse a result of poor judgement or fraud? Technically, it looks more like a Lehman scenario where FTX ran into a crisis of confidence that turned into a run on the bank. Creating a token (FTT) and pledging it as collateral is not illegal, although it may be unwise.

The second BIG question will be how were the customer account documents written and was FTX allowed to rehypothecate customer funds so long as they were collateralized by another asset, in this case FTT tokens? If the customer docs were written as such, which is a common standard for Prime Brokerage, then it is likely a case of mismanagement and poor judgement rather than outright fraud.

Time will tell.

BOOK | MOVIE RIGHTS?

This is the sort of stuff that would make for a great book, and fear not, you will not be disappointed to hear that the esteemed author Michael Lewis was embedded with Sam Bankman-Fried for more than six months and it looks like Creative Artist Agency was already shopping the movie rights before Lewis even put pen to paper.

This is going to be juicy!

CONFERENCES:

Northern California Institutional Forum, December 7th in Napa California: This event is organized by the Markets Group and is designed to bring together fund leadership teams, investment officers, board members, trustees, and their consultants representing the Northern California institutional investment community.

Innovations in Lending, Alternative Financing, Fintech & Private Credit Summit 2022, December 7-9 in Dana Point California: This event is organized by Opal and is designed for attendees to learn and network with industry leaders to gain insight on the newest techniques to maximize returns and reduce risk exposure in this growing area of marketplace lending.

PODCAST | VIDEOS:

Dechert's Spangler on FTX's Bankruptcy: Timothy Spangler, Partner at Dechert LLP, discusses crypto firm bankruptcies and the underlying legal and technological issues that are unique and still under-explored with Bloomberg News.

Whiffs of Enron?: Larry Summers on Wall Street Week discusses the FTX collapse and thinks that it may be more similar to Enron than Lehman Brothers.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter