I hope that you are off to a great start this week!

Jenn and I celebrated her brother’s birthday with a little family time at the K1 Speed race track in Dublin California this weekend. It was my first time racing Go Karts and I can say that if you have kids over 58” tall, it is a super fun family activity!

MARKET RECAP:

Central Banks remain accommodating globally resulting in lower interest rates and strong equity markets. The S&P 500 continues to look constructive with a slight bias to higher levels. The chart below remains in play and support comes in around 3,100.

The 10 year US Treasury bond remains in a sideways channel with a range of 1.50% - 3.00%. The secular bull market in interest rates began in 1982 when Paul Volcker and Ronald Reagan finally broke the back of inflation. Rates reached their lows during the Great Recession at 1.39% and were retested in 2015 at 1.34% (see chart below).

In the near term, I expect the channel to hold. If it doesn’t we have bigger issues.

The BIG question on my mind is could interest rates in the United States follow Europe and Japan and eventually go negative?

NEGATIVE RATES:

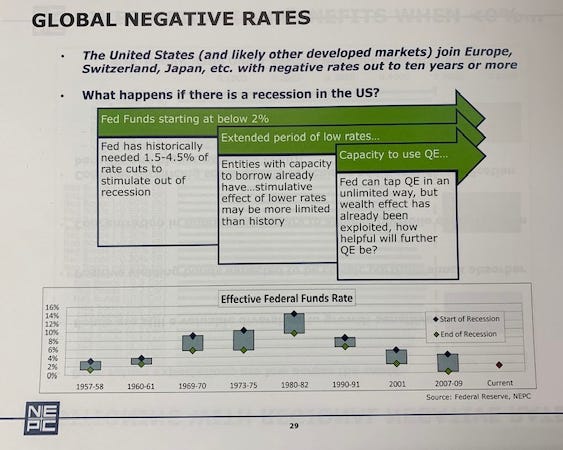

Last week I had the good fortune of attending a workshop with our investment consultant Don Stracke of NEPC. One presentation that I found to be particularly interesting was the session titled “Investing in a Negative Rate Environment” with Tim McCusker.

I asked Tim if he thought negative rates could surface in the United States?

Tim pulled up the slide below that illustrates that in a recession the Federal Reserve typically lower interest rates 1.50% - 4.50%. So, from where we are starting today it is entirely possible that rates could go negative in the United States if we entered a recession prior to rates normalizing.

A pretty tricky time to be in Chairman Powell’s shoes guiding the Federal Reserve. Lets hope that the Corona virus is contained and that there are no unforeseen shocks to the global economic system. Fingers crossed!

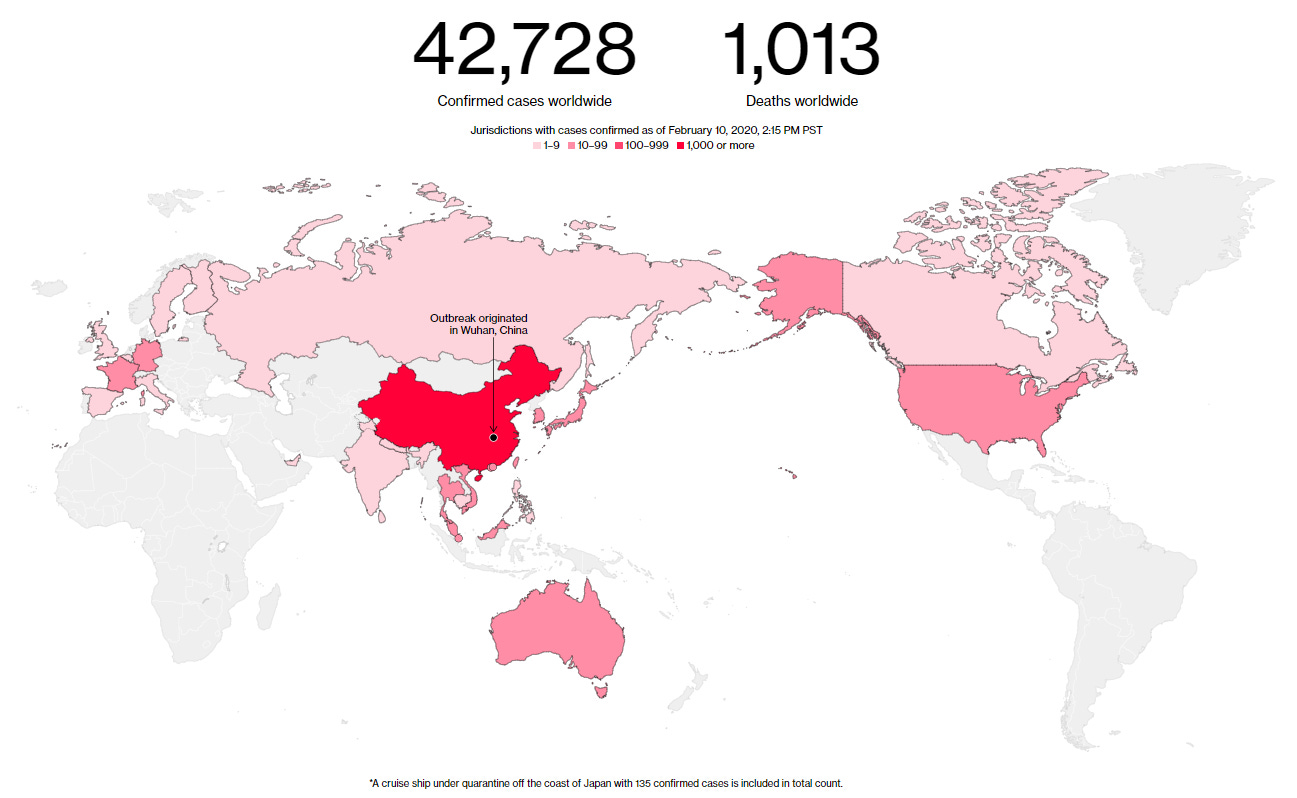

The death toll from the Corona virus (1,013) has now exceeded the 2003 SARS (774) epidemic. However, the Corona virus pathogen has a mortality rate of 1-2% compared to SARS 10% according to Bloomberg.

China has locked down entire cities, with some estimates saying that 48 million Chinese residents have been effected. The city of Wuhan is actually bigger than New York or London (see below).

Below is a graphic, also from Bloomberg, showing the drop in flights departing major Chinese airports.

PODCAST:

Jelly Donut Podcast - Mark Yusko of Morgan Creek, if you are interested in the macro economy you will enjoy this podcast. Ryan and Mark discuss current global macro conditions, zero interest rates and quantitative easing. I found it to be a really interesting episode.

Tim Ferris Podcast with Tony Fadell, if you love all things Apple as I do you will enjoy hearing Tony’s stories about how they created the iPod and iPhone and equally interesting how he lives his life today.

BOOK:

Stephen Schwarzman's What It Takes: Lessons in the Pursuit of Excellence that provides some insight into the rise of Blackstone and Schwarzman himself. No short cuts here, a lot of hard work combined with some luck and a great mentor in Pete Peterson.

CONFERENCES:

I’ll be at the following conferences, if you are too, let me know and we’ll circle up!

February 25-26 - Austin Texas for II’s Global Real Assets Investment Forum

March 6-8 - Lake Tahoe California for the Squaw Valley FinTech Symposium. I am co-hosting a dozen FinTech investors and Entrepreneurs in Tahoe for a weekend of skiing and ideating on the FinTech space. The focus will be on digital banks and investment management, if you plan to be in the area and would like to join the discussion DM me.

April 2-3 - Los Angeles California for the ALTSLA2020 conference; I’ll be on the Venture Capital / Angel Investor panel.

April 14-15 - San Francisco California for the Pension Bridge conference.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. And if you are interested in startups you can join over 700 other backers that follow my syndicate here at Angel List Syndicate, this gives you a front row seat on which private companies I am investing in directly.

Have a great weekend!

- Sean Bill / MacroCrunch