How Low Can We Go?

Issue #36

I hope this note finds you and your family safe and healthy.

Last week 10yr US government yields hit all-time multi-century lows, dipping below the pandemic risk-off level we saw in March. The US has been through depressions, deflations, wars, market crashes and many other major events, but since the Founding Fathers formed the country we have never seen yields this low.

There are positive and negative tradeoffs to low interest rates. The most obvious negatives are that contracting GDP and increasing unemployment are the motivation for the FED to keep interest rates near zero. Many of our friends and neighbors are suffering the economic consequences of the the COVID-19 pandemic.

However, if you are still employed and own a home you are able to lock in historically low mortgage rates or better yet you could shorten your mortgage and keep your payment unchanged. That is a pretty big benefit.

And, if you need a new car you can borrow money at 0% for up to 72 months, another big benefit to the consumer. Companies like AutoFi, a company that provides contactless online auto loans, is experiencing accelerated growth as a result of the pandemic. I invested in this company’s seed round and led their syndicate in 2015, they just closed a Series B round.

GDP:

Last week Q2 GDP numbers were released and showed a decline of 32.9% annualized. The drop in second-quarter GDP was nearly four times worse than during the peak of the financial crisis, when the economy contracted 8.4% annualized in the fourth quarter of 2008. The pandemic has pushed the US economy off a cliff.

So what’s next?

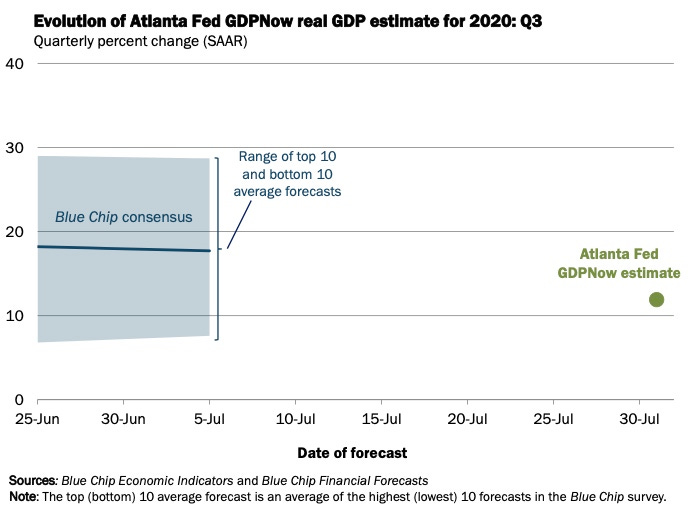

Currently the Atlanta Fed GDP NOW model is forecasting 11.9% annualized growth in Q3 2020. That is noticeably lower than the consensus estimates of professional economist. But, the GDP NOW model was only off by 0.80% on the Q2 2020 numbers reported last Thursday, so hopefully we have seen the worst of the economic contraction.

PODCAST | YOUTUBE:

Munk Dialogue with Mohamed El-Erian: If you have time for only one podcast this weekend I would highly recommend this interview with Mohamed El-Erian. He discusses his 2016 book The Only Game in Town which covers the Global Central Banks’ playbook for the next crisis. Four years later it is playing out, this one is well worth your time.

RANDOM:

Below is a picture of Mohamed and I at a breakfast in Abu Dhabi a few months ago. Mohamed was delivering a speech to a small group of sovereign wealth funds discussing his outlook for the global economy and portfolio construction.

Mohamed is a super humble and ridiculously smart person.

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that back my syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch