ELECTIONS, BITCOIN and M2

Issue #44

Hi, I hope this note finds you safe and healthy.

It’s been a while since I have had the time to sit down and write a MacroCrunch. The markets have been very volatile and the elections have been a big distraction. Volatility has retreated, at least for now, but my guess is that the election will remain a big distraction until the Joint Session of Congress is held on January 6th to count the electoral college votes and officially designate the President Elect.

I am going to leave the political analysis to the pundits who are much better resourced. But, I will say that neither party won a clear mandate for change. The Republicans picked up seats in the House and the Democrats picked up seats in the Senate. Questions on mail in ballots, the Dominion software used to count ballots and the ownership structure of Dominion will all be sorted out through the court system. I saw an interview with Mitt Romney that I thought threaded the needle on these issues, you can watch it here.

MARKETS:

Readers of MacroCrunch know that I am a strong believer that you should NEVER fight the BOJ, ECB, FED and PBOC when they are pumping liquidity into the markets. The Zero Interest Rate Policy (ZIRP) and the massive Quantitative Easing (QE) programs force all investors out the risk curve in search of return.

I am seeing this first hand with the pensions I manage at the VTA. I have been extremely busy working with our consultant Don Stracke of NEPC to revamp our asset allocation. At a high level, we are shifting assets from absolute return hedge funds to private credit, reducing active management in public equities and adding a small private equity allocation. These changes do reflect the pressure to move out the risk curve to meet return assumptions, which we have been steadily reducing.

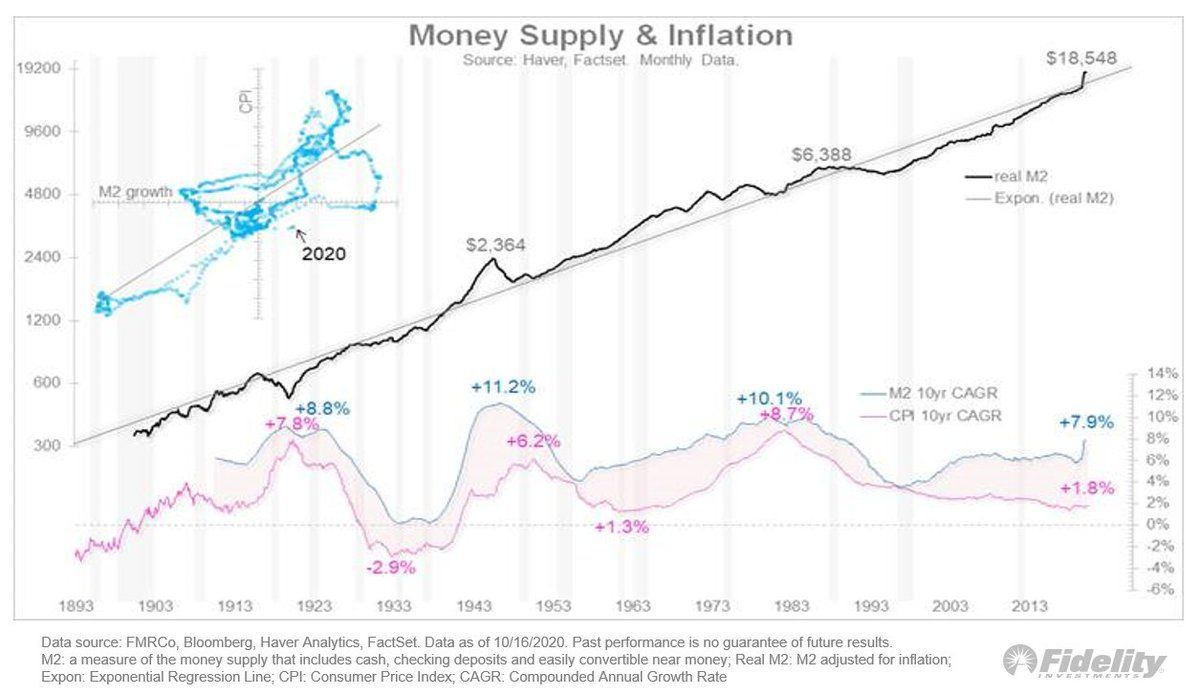

Below is an interesting chart from Jurrien Timmer of Fidelity Investments showing the growth in the M2 money supply versus CPI. Jurrien looks at the data using the 10 year compounded annualized growth rate and it does seem to indicate that we should expect higher rates of inflation going forward.

There are two primary inputs to inflation, growth in money supply and the velocity of money. Part duo, the velocity of money, is the BIG question on a forward looking basis. If the vaccines are available and effective then the velocity should be stable to positive and would indicate that the chart above is the one to watch. However, if we enter another wave of COVID-19 and extended lockdowns we would expect velocity to go negative which would offset the growth in M2 and would mute inflation.

We could also go into a lot of detail on “Debt Deleveraging”, but I’ll save that for another MacroCrunch as I am short on time. If you are interested in exploring Deflation and Debt Deleveraging I recommend starting out with former Fed Chair Bernanke’s speech titled Deflation: Making Sure "It" Doesn't Happen Here.

BITCOIN:

Last year I asked Mark Yusko and Anthony Pompliano to present to our Pension Board on the topic of Digital Investments and Digital Currencies. Mark came out and walked through the endowment model, private investments, venture capital and the new frontier of digitial assets. He ended his presentation with an overview of Bitcoin and how it could potentially fit into a broadly diversified portfolio.

Mark’s Partner Anthony Pompliano is famous for saying “Get Off Zero” (I highly recommend Pomp’s letter if you are interested in FinTech and digitial currencies). I think that he is right, every portfolio should have an allocation of 1 - 3 percent to Bitcoin. It is a great hedge if central banks / govenrments continue to debase their currencies. It is basically a digitial version of Gold.

The above is NOT investment advice, do your own research and make informed decisions. But the charts for Bitcoin look very constructive, see below.

The $13,865 level on Bitcoin was resistance and should now be technical support. It was the June 26, 2019 high and prior to breaking out it only spent 39 days above the $13,865 level. This is a hyper volatile market and should be treated as such when sizing risk capital.

STARTUPS:

As many of you know I am an active angel investor with a strong focus on FinTech, GovTech and AI/ML. Last week I had the chance to visit with a couple startups that I think are super interesting.

JIKO:

Last week I had a Zoom call with Stephane Lintner, the founder of a super interesting startup called Jiko.io, a challenger bank that actually has a US Bank charter!

Forbes summed it up, “most existing fintech challengers spent years acquiring customers with slick apps and no-hidden-fee promises, only later worrying about offsetting mounting costs of customer acquisition, partly by bringing deposit-taking in-house. Lending Club, an early fintech pioneer, bought Radius Bank for $185 million in February. Startup Varo received a national banking charter this year. Square and, more recently, SoFi got approvals to become banks too.

Jiko took the reverse approach. Founded four years ago by Stephane Lintner, a former Goldman Sachs trader, Jiko set out first to acquire an existing bank before debuting a product. Investors’ funds were held in escrow for two years while Jiko pursued purchasing 63-year-old Mid-Central National Bank, based in Minnesota, a deal it consummated in September”.

I think that this is a startup to watch and invest some capital in when they raise their next round. Super impressive founder with a deep domain expertise and a massive total addressible market (TAM).

MOMENTUM DYNAMICS:

Another favorite startup of mine is Momentum Dynamics.

Wireless charging company Momentum Dynamics continues to launch pilot projects across the globe. Last week Momentum announced the United Kingdom’s first wireless electric van charging trial at Heriot-Watt University, which is located on the outskirts of Edinburgh, as reported by Alastair Dalton of The Scotsman.

The university said the project’s success could see van fleets across the UK using such chargers, which take 30-60 minutes to top up batteries. Notably, the equiptment is future proofed in that an autonomous vehicle can use the system to recharge with out the need of human assistance.

The graphic above shows how the technology works. Basically, the charging platform is placed in the ground and covered, a recieving adaptor is connected underneath the vehicle to be charged. When vehicle is parked over the charge pad the electricity is transferred wirelessly to the vehicle.

As companies like Amazon, DHL, FedEx and UPS move towards electric fleets it is easy to envision a massive use case for for Momentum’s wireless charging systems. Why not recharge the delivery van while it is being reloaded?

If you want to learn more, check out this five minute video on Resonant Magnetic Induction, it’s a critical piece to the evolution to autonomous mobility and here is an interesting article on Amazon and their quest to transition to an electric fleet.

PODCAST:

Silicon Valley Insider: Interview with Chooch co-founder and CEO Emrah Gultekin. Emrah discusses why Chooch is trying to solve a fundamental problem for visual A.I. to acquire visual expertise in a structured way similar to human knowledge.

Invest Like the Best: Interview with Wabash College alum Brad Gerstner of Altimeter Capital on his investment philosophy and how he manages investments in both the public and private markets. It is a very interesting interview.

Hat tip to Sharam Honari for pointing out these two super interesting podcast!

I hope you enjoyed the letter and as always feel free to share it with friends and colleagues. If you are interested in startups you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. - Sean Bill / MacroCrunch