Hi,

I hope that this note finds you doing well and enjoying a weekend of March Madness! It was certainly a great weekend for Los Angeles….

ECON 101:

What does it look like when the lessons learned in Econ 101 no longer seem relevant?

The Citi Economic Surprise Index (US), which tracks how economic data is coming in relative to forecasts, seems to be losing relevance. In the pre-2009 era this was an insightful indicator that could help you gauge the relative value of the market vs. the underlying economy.

Today it seems like fiscal and monetary policies are overwhelming economic fundamentals, particularly the latter. The power of Zero Interest Rate Policies (ZIRP) and Quantitative Easing (QE) are the most important market drivers. You can forget about everything else. See the chart below,

As long as the Bank of Japan, the European Central Bank, the Federal Reserve and the Peoples Bank of China continue with easy monetary policies the above chart is the one you want to keep an eye on for market guidance.

DeFi:

Another area that I am becoming extremely interested in is Decentralized Finance or DeFi. I am just starting to peel back the onion on this topic, but from what I have seen so far it feels a lot like FinTech in 2012. It is just starting to build momentum and the tools and technology are catching up to the concepts of DeFi.

From CoinDesk, “DeFi draws inspiration from blockchain, the technology behind the digital currency bitcoin, which allows several entities to hold a copy of a history of transactions, meaning it isn’t controlled by a single, central source. That’s important because centralized systems and human gatekeepers can limit the speed and sophistication of transactions while offering users less direct control over their money”.

Stay tuned, I’ll be writing a lot more about this in the future, but if you want to dip your toe into the pool, listen to the podcast I recorded with Lex Sokolin (link below). Lex is really well versed in this topic and is able to translate complex concepts into language for the layman.

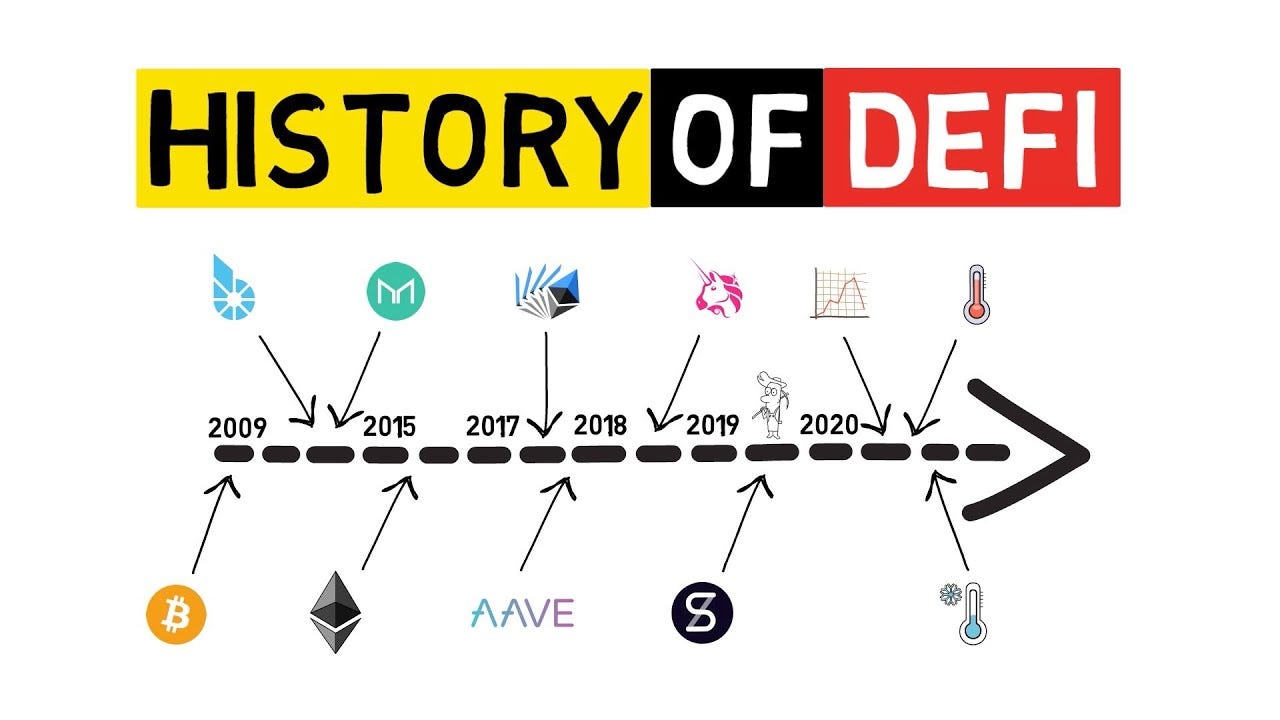

I also found this video on the History of DeFi, which was interesting.

PODCAST:

MacroCrunch: In this episode I interview Lex Sokolin, a futurist and entrepreneur working on the next generation of financial services. He is the Global Fintech Co-Head at ConsenSys, a blockchain technology company building the infrastructure, applications, and practices that enable a decentralized world. Lex focuses on emerging digital assets, public and private enterprise blockchain solutions, decentralized finance and autonomous organizations. If you are interested in FinTech I highly recommend Lex’s free weekly letter The FinTech Blueprint and you can follow him on Twitter @lexsokolin.

You can listen to today’s podcast on Apple or Spotify.

I hope that you enjoy the letter as much as I enjoyed making it and please feel free to share the links with friends and associates and if you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. Sean Bill / MacroCrunch / Twitter