BITCOIN & PORTFOLIO THEORY

Issue # 51

DIVERSIFICATION:

On July 9, 2019 I invited Mark Yusko of Morgan Creek to present to my Pension Board on the potential benefits of adding a small exposure of bitcoin to our portfolios. The correlation to other asset classes was low and the sharp ratio was high. My thoughts were that a small exposure to bitcoin, 0.50% - 3.0% of the portfolio, would improve risk adjusted returns. At that time bitcoin was trading at +/- $10,000 per coin.

Below is slide #149 from the presentation which illustrates the benefits of adding bitcoin to a traditional 60/40 asset allocation.

CORRELATIONS:

With the recent move in Bitcoin I thought it would be worth refreshing the data. As bitcoin has become more widely held it does appear that the correlation to other asset classes has increased. Over the past year bitcoin’s correlation to the S&P 500 has been 0.34 versus 0.14 over the last five years.

Below is a chart that illustrates the inflows of capital into the Grayscale BTC Fund (red) and the concurrent increasing correlations between bitcoin and Gold (green) and bitcoin and the SP 500 index (blue).

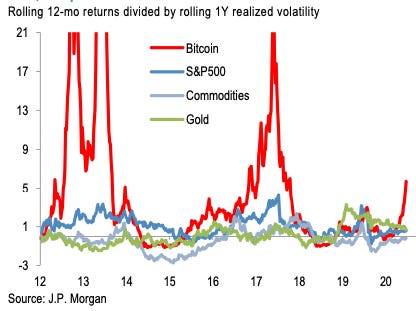

As the correlation of bitcoin increases relative to other asset classes the benefit of adding it to a portfolio declines. As we saw above, as you shorten the time horizon the correlations steadily increase reducing the benefits of adding BTC to a portfolio. See the graph below, courtesy of JPM.

VOLATILITY:

No suprise that bitcoin is extremely volatile. Volatility in itself is not necessarily a negative, it can be quite positive. But it can also be very dificult for novice investors to maintain conviction when the markets are volatile to the downside. See graphs below for three month and one year volatility.

PORTFOLIO HEDGE?

No, not a good choice to use bitcoin as a hedge against equity market selloffs. You can see in the table below that you would be better off with US treasuries or US Dollar vs. EM FX crosses as a hedge. The data would indicate that bitcoin gets caught up in the risk on / risk off trade and offers negative returns during equity market selloffs.

To hedge inflation or a decline in the dollar would be a different story.

CONCLUSION:

If you already own bitcoin and have held it in your portfolio it has served you very well. It has improved your risk adjusted returns accross all time periods. On a forward looking basis it still offers value, but as more investors enter the market the correlation to other asset classes is likely to continue to increase and thus reduce its benefit as a diversifying asset.

If I were recommending bitcoin to my Board today I would suggest an allocation of 0.50% - 1.5%, instead of the 0.50% - 3.0% weight I suggested in 2019. An allocation still makes sense, but in smaller size.

And in case you missed it, here is a current chart on BTC.

PODCAST:

Meb Faber Show: A great discussion on financial bubbles and market valuations with Jeremy Grantham of GMO. Jeremy also explains why he is so bullish on venture capital and has allocated almost 60% of his foundation to the asset class, making it, as he says, one of the most aggressive portfolios in the philanthropic world.

Something Ventured: In this episode Kent interviews Amy Nauiokas the CEO of Anthemis Group, a fintech focused venture fund. She discusses her path to a career in venture capital and the strength garnered from a diverse team of men and women from accros the globe.

I hope that you enjoy the letter as much as I enjoyed making it and please feel free to share the links with friends and associates and if you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. Sean Bill / MacroCrunch / Twitter