Hi All,

It has been a while since I have had time to put together a MacroCrunch letter….

As many of you know I recently retired from the VTA after 10 years as the Treasurer and Chief Investment Officer (CIO). Over that time period I had the good fortune to serve as both the Chairman and CIO of the VTA Retirees’ Other Post-Employment Benefits Trust. During my tenure, the OPEB Trust generated a 10.40% annualized net return for the decade, outperforming its benchmark return of 9.80%; more importantly the Trust is 125% funded at a discount rate of 6.75%, which is great for VTA Retirees.

I really enjoyed my work at the VTA, but after 10 years I felt that it was time to re-pot myself and to seek new challenges. The area of investing that I think has the best risk adjusted returns and a very strong tail wind to boot, is alternative private credit. With innovations in FinTech and DeFi and with with Global Central Banks exiting Zero Interest Rate Policies (ZIRP) and Quantitative Easing (QE) programs, there is a very strong case to be made that alternative private credit will offer the best risk adjusted returns for the next decade.

With that, I am pleased to share that I have joined Prime Meridian Capital Management as the Chief Investment Officer and Co-Portfolio Manager. Prime Meridian is an Alternative Credit Fund based in the San Francisco Bay Area with $250 million under management. The firm works closely with Founders and CEOs of fintech lending platforms, crafting win-win partnerships that allow their platforms to scale. The firm has deep roots in the FinTech space and has funded $1.7 billion across 100,000 loans. Verticals include consumer, real estate, small business loans, and secured credit facilities, as well as life settlements, litigation finance and music royalties. The portfolios’ short short duration and high yield, positions it to take advantage of a rising interest rate environment. Needless to say, I am very excited to have this opportunity.

If you are looking for steady, uncorrelated returns, give me a call or feel free to DM me.

ANGEL INVESTING | VENTURE CAPITAL

It’s been a while since I have been able to provide an update my favorite hobby, my Angel investing activities. The most recent public deal that invested in was Angel List. The valuation was high, but I believe that the platform is the #1 player in three high growth verticals.

First, it is the unquestioned leader in marketplaces for startups to raise capital, see Angel List.

Second, it is the leading platform for technology companies seeking to hire software engineers and other professionals, see Angel List Talent.

Third, it is the leading website to launch and promote new products, see Product Hunt.

Angel List is the platform that enabled me to begin Angel investing and to begin syndicating Angel investments, see FinTech Angels. Building a track record on Angel List, also enabled me to launch a Venture Fund, see ReCurve Ventures.

Below is my public Angel List track record from inception through June 30, 2022.

With regard to the above graph the early investments have had a chance to grow and all of the seed investments have gone on to secure a Series A investment and in some cases a Series B (AutoFi, Kueski). The 2020 and 2021 vintages include two follow on rounds for Chooch (Series A) and Kueski (Series B) and four new investments, two of which will have an up round in 2022/23. The other two are chugging along with plenty of runway to make it through a downturn if the economy remains under pressure.

Going forward I am looking to increase my activity in the picks and shovels of the blockchain, DeFi and Web 3.0 space. Today feels a lot like 2012 did for FinTech, but now for blockchain and DeFi. I am looking for pure plays and to invest between $100,000 - $250,000 in 20 - 30 companies / DAOs over the next 24 - 36 months. If that sounds interesting to you, my fund is still open to new investors, click here or DM me.

MARKETS:

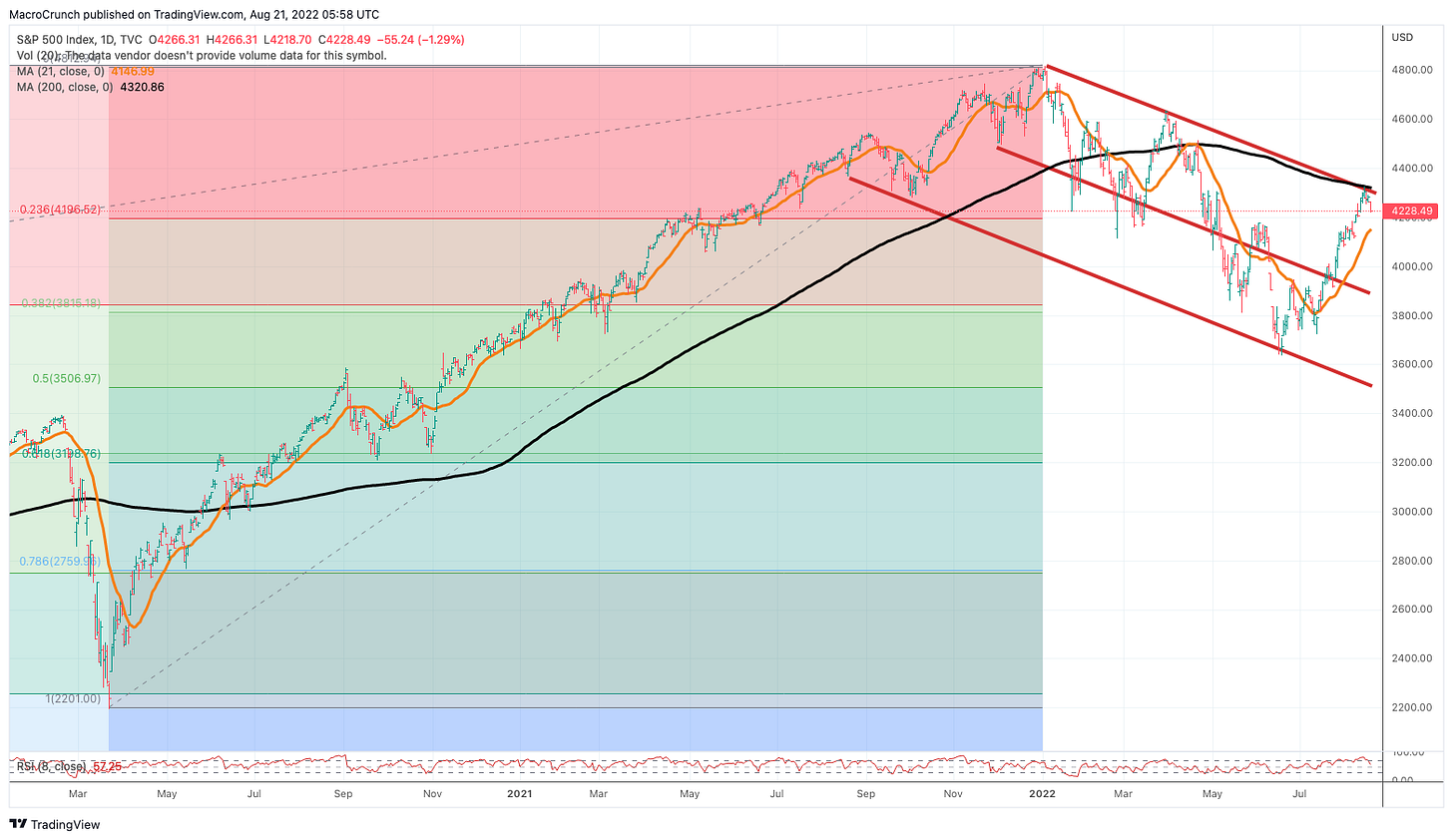

The selloff in the S&P 500 during the first half of 2022 was the worst since 1970. I thought that it was interesting that the market rebounded and hit resistance levels at the 200 day moving average, a .618% Fibonacci retracement, and an old school overhead trendline. The next couple of weeks will be very interesting to see if the market makes another run at the 200 day moving average or whether it resumes the downtrend for a retest of the lows.

On a longer term chart that captures the rally off the pandemic lows at 2,201 through the highs at 4,418, the market looks much more vulnerable to a retest of the lows. The entire rally was driven by massive monetary and fiscal stimulus, both of which have run their course. Central Banks around the world are tightening, QE balance sheets are rolling off and governments have maxed out their fiscal stimulus programs. A Fibonacci retracement of the entire move would suggest 3,200 - 3,500, or basically back to pre-pandemic levels!

Also note that the US Dollar is surging back to its recent highs. In my mind that is the ultimate wrecking ball and points to a shortage of Dollars, but that will have to wait for another blog post. In the meantime, lets see what Saudi Arabia decides to do about Xi’s proposal that they trade oil in Renminbi rather than Dollars.

VIDEOS | PODCAST

ALL IN PODCAST, EPISODE 92: This is a great roundup on current events with a technology perspective on venture investing, macro economics and geopolitics. This week they cover Adam Neumann's second act, a16z's $350M bet, housing policy, Inflation Reduction Act & more.

THE RISE OF PICKLEBALL: Everyone is playing Pickleball, here is the orgin story! In the summer of 1965, seeking to keep their bored kids entertained, some dads on Bainbridge Island, Washington, invented a game using a plastic ball, some wood, and a badminton court. "Pickleball" was born.

CONFERENCES | TRAVEL

SALT NEW YORK 2022: September 12 - 14, I will be in New York attending the SALT Conference and look forward to connecting with fellow investors and allocators.

DIGITAL ASSET SUMMIT 2022: September 13 -14, I will be in New York attending the DAS 2022 Summit and look forward to hearing the latest on digital assets market structure, staking and lending.

JAMES ALPHA MANAGEMENT: September 15, I will be in New York to moderate a breakfast round table discussion on digital assets hosted by James Alpha Management. I am looking forward to hearing how managers are approaching the digital assets markets given the recent volatility and their outlooks for 2023.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter

Great update! Good to hear from you.