Hi All,

I hope that you are having a great week!

Before we jump into the five factors driving the global economy I thought I would share the chart below from Ned Davis Research which illustrates that this is the worst start to a year for a 60/40 portfolio with the exception of 1931 and 1974.

As I mentioned in the prior MacroCrunch, it is a rather unusual situation when both stocks and bonds decline at the same time. I will write more on this in future issues. In the meantime, cash is king and those who have it will be well positioned to do some shopping in the near future.

Send me your best idea and I will share my shopping list with you!

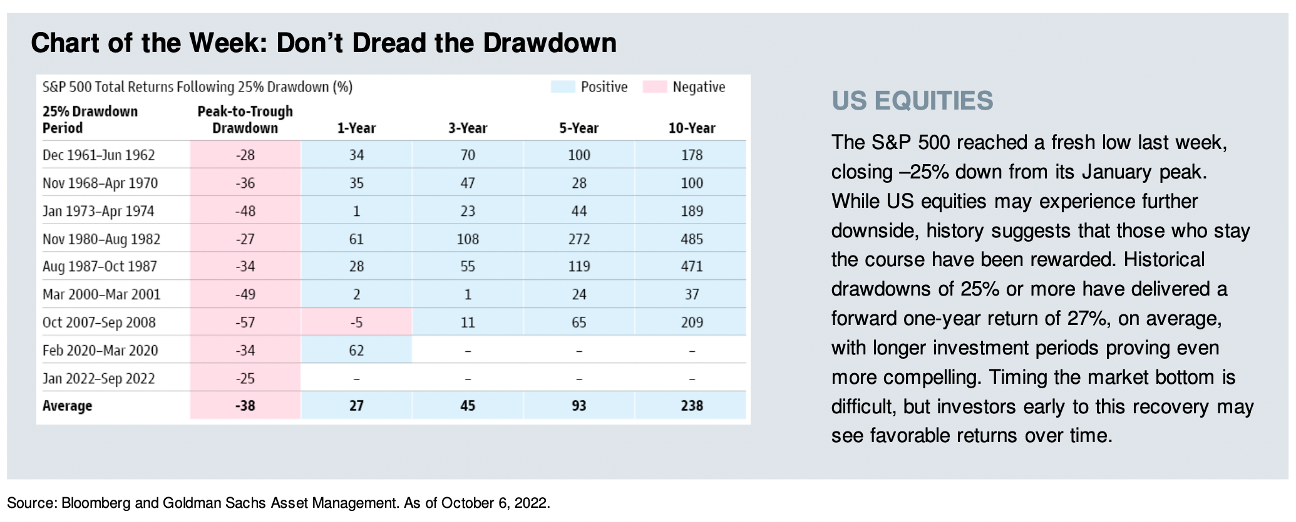

On the Flip Side, don’t dread the downturn as it will create opportunity for significant gains. We want to stay mentally flexible here and have our shopping list ready. See the chart below courtesy of Goldman Sachs.

FIVE FACTORS DRIVING THE US & GLOBAL ECONOMIES:

An old friend and long time subscriber to MacroCrunch shared his notes with me from a recent speech given by Robert Kaplan the Former President & CEO, Federal Reserve Bank of Dallas. Below is a summary of Mr. Kaplan’s Keynote at the Rice University Baker Institute’s Annual Energy Summit Day, link to the Institute here.

1) DEMOGRAPHICS – implications of aging workforce in the US and global populations. GDP growth is a function of growth in the workforce, plus growth and productivity. Discussions about 1980’s and Paul Volcker and how now is similar to 1980’s – not accurate.

a. When the FED was tightening monetary policy in the late 1970s and early 1980s, we could do it with some confidence because we had a demographic tailwind behind us with 2% growth in the workforce which decelerated over time to below 1% in the 2000s, we also didn’t have the debt we have today.

b. In the US today, workforce growth looks like it might be one quarter of 1% this decade, so it means we're starting with a headwind for GDP growth.

c. Solution, we need to get more women into the workforce, and although a sensitive topic, immigration has always been a key part of workforce growth in this country and is needed to increases labor supply

2) DEBT - End of the debt super cycle - every time the US has had an economic hiccup over the last 50 years we increased government spending, cut taxes and increased leverage / debt.

a. Pre COVID, debt to GDP was 70%, today debt to GDP is at 100%

b. The Fed balance sheet went from $4 trillion pre COVID to $9 trillion, and the present value of unfunded entitlements is now $65 trillion and rising (Medicare, Social Security, etc.)

c. Aging workforce vs. taxpayer ratio is not in our favor, less ability to use debt / leverage to drive GDP growth vs. the past

3) DEGLOBALIZATION – Globalization was disinflationary prior to COVID, now deglobalization is inflationary.

a. International arrangements enabled us to think about materials, energy and labor supply globally, that is no longer the case, security of supply chains has increased in importance

b. Wind, solar battery storage, electrification of the auto fleet requires all sorts of metals and mining, much of it sourced from China and other countries around the globe, could present issues going forward

c. We need substantially more semiconductors as they are component of everything

4) TECHNOLOGY - enables disruption, increases productivity and offsets demographics to a certain extent

a. Specifically, distributed computing in the last 10 or 15 years has accelerated the ability for technology to replace people

b. Workers of today, particularly if they haven't gone to college need different types of skills and need training (likely more than once) to gain literacy for new types of jobs

c. US educational system is lagging the rest of the world in STEM

5) ENERGY TRANSITION – We have supply and demand issues for energy, materials, goods as well as long-term labor shortages effecting the industry

a. It will take 20 to 25 years and cost anywhere from $150 trillion to $250 trillion for energy transition, for context US GDP is only $23 trillion

b. Energy supply gap exists in the near-term even if global oil demand were to peak in 5 years, there are not enough alternative forms of energy available to offset hydrocarbon demand

Wind and solar can’t fill the gap, energy storage is not perfected and there is little discussion about nuclear

Leads to price spikes, for hydrocarbons and their derivative products

Low-income families bear the brunt of price shocks to food, rent, healthcare costs, etc.

c. Proper energy transition requires government to encourage more fossil fuel production over next 5 years

By not encouraging domestic production we are forcing poor countries to burn more coal which is worse for the environment

Much harder for hydrocarbon industry to gain access to both equity and credit today

We should have a national plan to encourage hydrocarbon growth over next 5 to 10 years while we encourage alternatives and new forms of technology

We need to be able to discuss all forms of energy supply including nuclear – that is not the case today

d. UN plan is a great start but not realistic, expectations are for some miraculous output of supply to fill the energy gap. What is happening in Europe as it relates to energy supplies and prices should raise concerns here in the United States.

PODCAST / VIDEOS:

PLANET MONEY - Economic Anarchy in the UK - October 5, 2022: You may have seen or heard about the recent upheaval in interest rates in the UK, this episode of Planet Money explains what happened.

THE COMPOUND - A Major Margin Call - October 10, 2022: Marc Rubinstein joins Josh Brown and Michael Batnick to discuss margin calls in the UK, Credit Suisse's "Lehman moment," the growth of shadow banking, and more! This is a very interesting interview for those who wish to peel back the onion a bit.

TIM FERRIS SHOW #627 - Brian Armstrong, CEO of Coinbase: The Art of Relentless Focus, Preparing for Full-Contact Entrepreneurship, Critical Forks in the Path, Handling Haters, The Wisdom of Paul Graham, Epigenetic Reprogramming, and Much More.

CONFERENCES:

HFM US AWARDS 2022 - October 17/18 - NYC: The Prime Meridian Special Opportunities Fund is a Finalist for Best Multi-Strategy Hedge Fund. I’ll be in NYC for meetings and to attend the Awards Ceremony.

HEDGEWEEK US AWARDS 2022 - October 27/28 - NYC: The Prime Meridian Income Fund is a Finalist for Best Multi-Strategy Credit Hedge Fund and the Prime Meridian Real Estate Fund is a Finalist for Best Direct Lending Credit Hedge Fund.

SALT iConnections Asia 2022 - November 14-16 - Singapore: SALT and iConnections are teaming up for their first joint conference, SALT iConnections Asia. I am looking into attending this conference to showcase Prime Meridian’s Alternative Credit strategies to Asian investors. Let me know if you plan to attend.

PRIVATE CREDIT SUMMIT - December 7-9 - Dana Point California: I will be participating in a panel on Current Opportunities in Alternative Credit including insurance-linked assets, litigation finance and music royalties.

I hope that you enjoy the letter as much as I enjoyed writing it and please feel free to share the links with friends and associates. If you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Stay safe and stay well. Sean Bill / MacroCrunch / Twitter