$112 TRILLION

Issue # 55

Hi,

I hope this note finds you in good health and cheer!

I recently got my second shot of the Pfizer Covid-19 vaccine. It is hard to believe that this event has been with us for over a year now and continues to disrupt lives and economies across the globe.

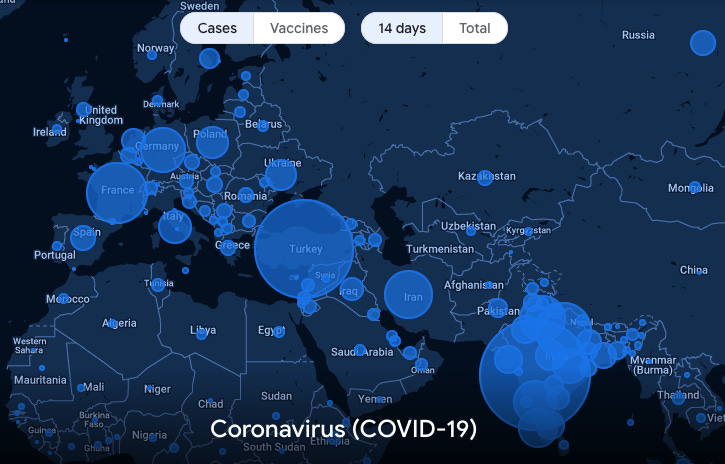

The recent resurgence of Covid-19 in Europe and the new strains ravaging India are cause for concern. The graphic below from Johns Hopkins University illustrates the increase in new cases over the last 14 days.

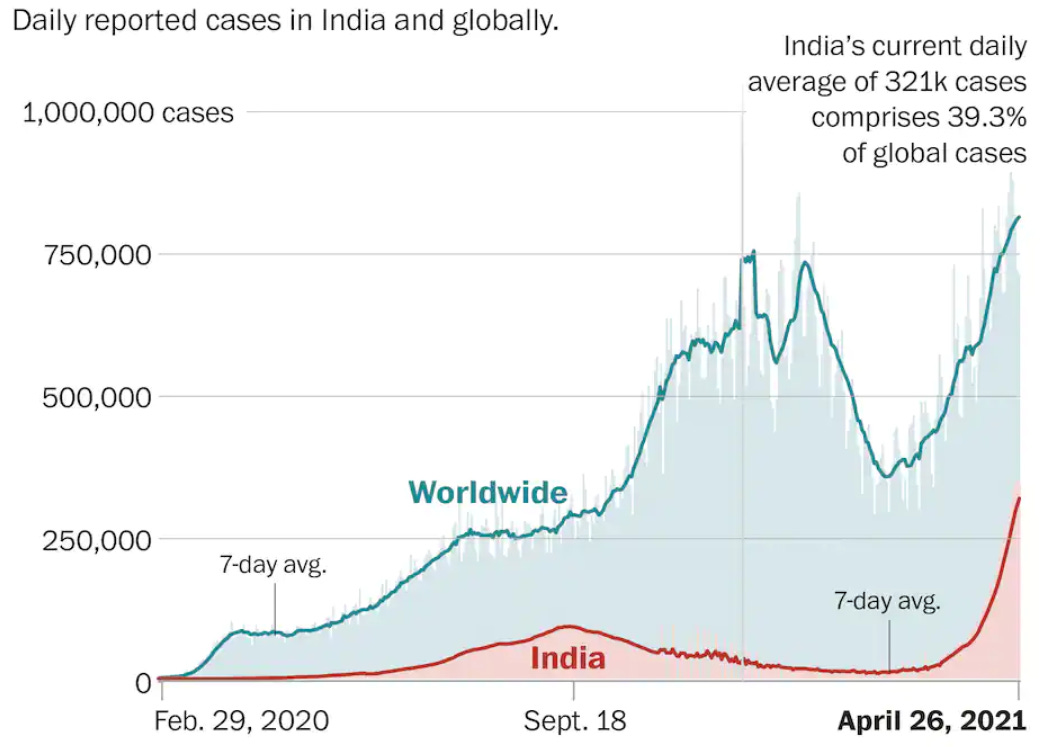

While many countries are experiencing a resurgence, the most recent data indicates that 1 out 3 new cases of Covid-19 are occurring in India.

From the Washington Post, “Tedros Adhanom Ghebreyesus, the head of the World Health Organization, called the situation in India “beyond heartbreaking.” He warned that many countries in the world “are still experiencing intense transmission,” with more new cases globally in the past week than in the first five months of the pandemic”.

MARKETS:

Interestingly, concerns over the resurgence of Covid-19 have NOT affected markets.

Central bank easy money policies and massive fiscal spending are fueling the markets steady march higher. For the month of April, global markets are on track to add over $4 trillion in new market capitalization. That is a pretty BIG number.

Global stocks are now worth $112 trillion, the highest market capitalization in history.

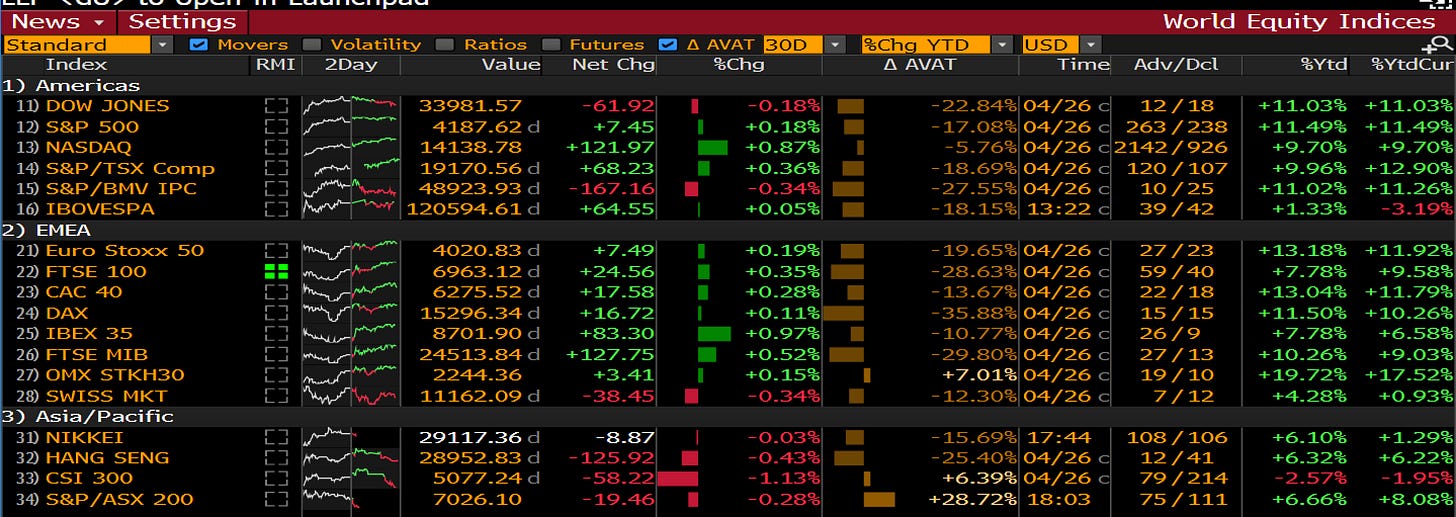

With very few exceptions, all major global equity markets are higher on a year to date basis. The far right column below illustrates returns in local currency terms.

It doesn’t really matter which equity market you invested in, just that you invested.

CONSUMERS:

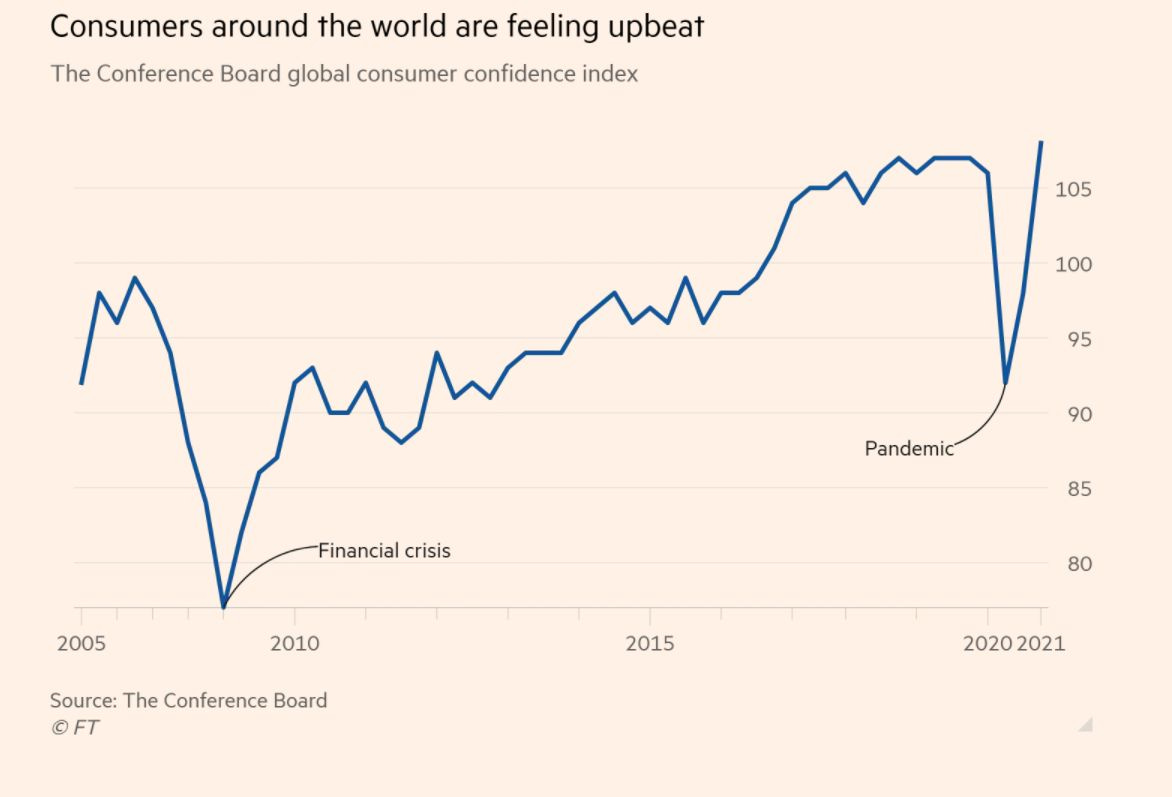

The consumer has benefited mightily from government largess.

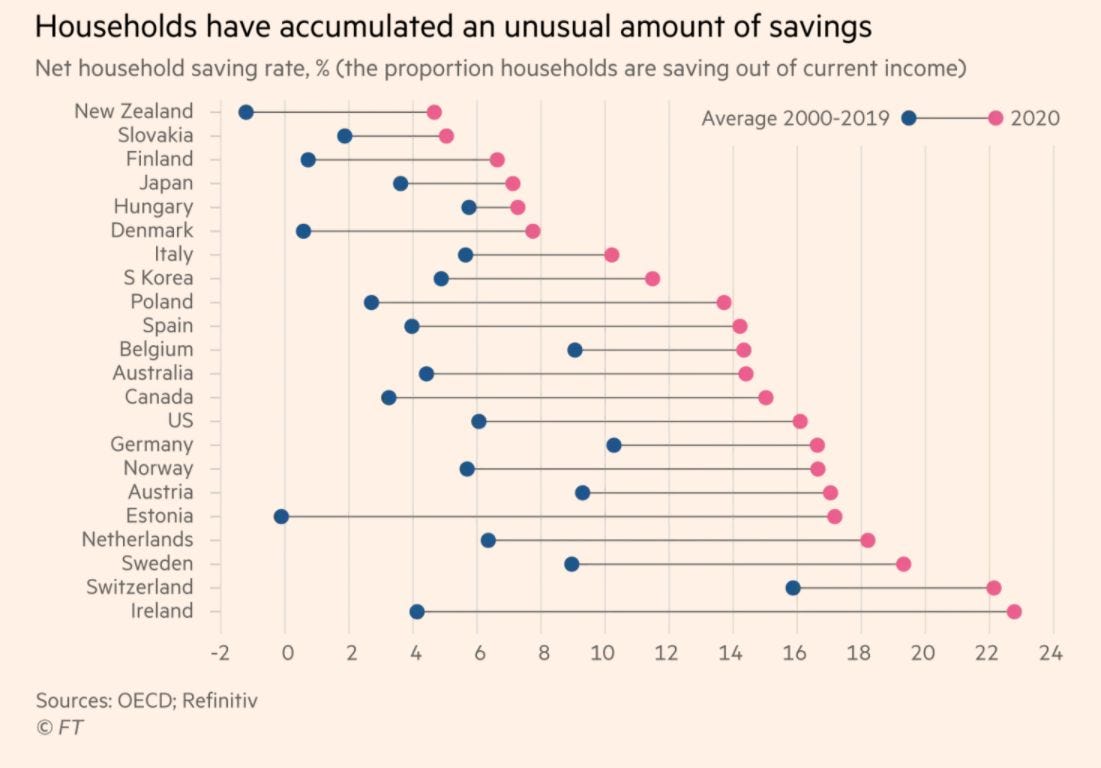

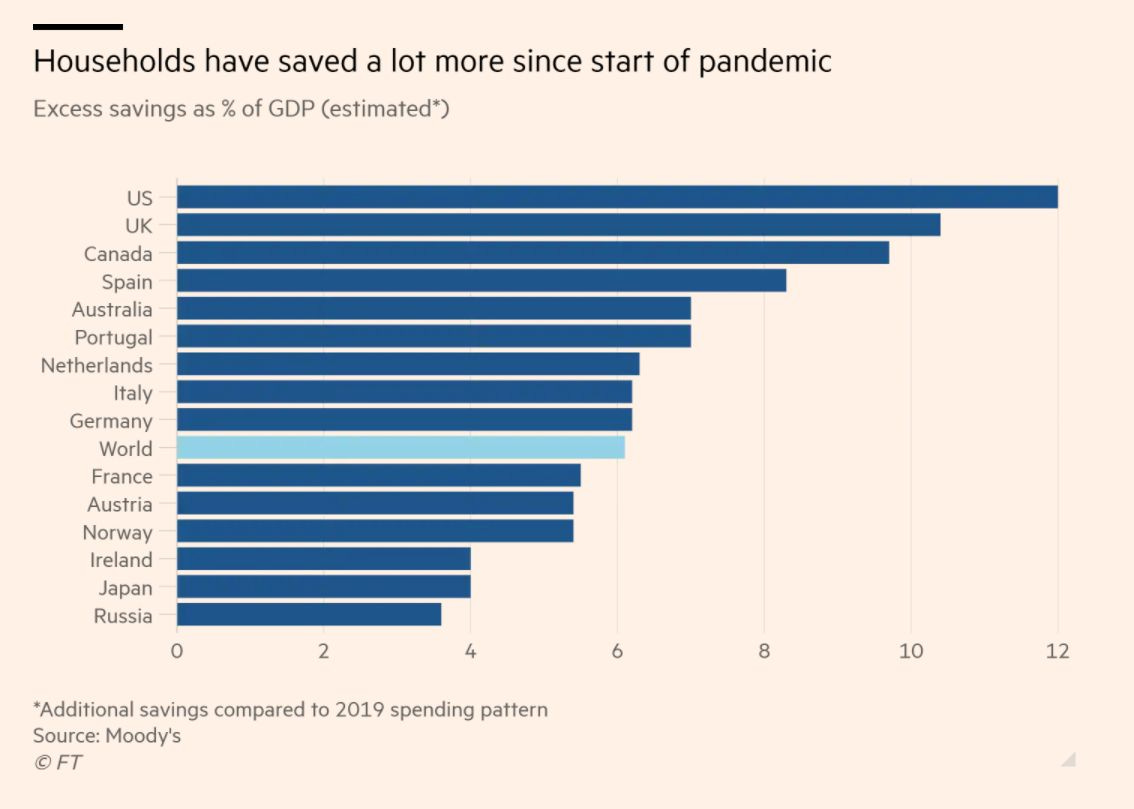

Consumer confidence and savings remain at record highs. Government transfer payments seem to be having their intended effect of buttressing the finances of those temporarily out of work or whose small businesses are struggling.

From the Financial Times, "Consumers around the world have stockpiled an extra $5.4tn of savings since the coronavirus pandemic began and are becoming increasingly confident about the economic outlook, paving the way for a strong rebound in spending as businesses reopen."

GARDEN:

The garden is starting to show some signs of life. My lettuce is coming in and I my snap peas are off to a good start. The latter are a favorite of the kids, they like to pick some pods for an occasional healthy snack!

I am also starting to get some peaches, but the damn peach leaf curl is back! Time to get back on YouTube to do some research…..

PODCAST:

Two podcast on what is happening in digital assets, DeFi and crypto currencies.

Real Vision: Dan Morehead, CEO and founder of Pantera Capital, joins Real Vision CEO Raoul Pal to discuss the current macro setup and its relationship to crypto as well as why this crypto bull market is different from the last and what the potential benefits could be from incoming regulations. Morehead also describes how he sees the crypto ecosystem evolving over the next few years and why the entry of Paypal into the crypto space is significant.

Bankless: In this episode Bankless Fan and SEC Commissioner Hester Peirce comes on the podcast to discuss tokens, DeFi, 'self-driving banks,' and regulation. This is probably my new favorite podcast. Every Friday they put out a summary of the weeks news in the DeFi space, it’s really good.

One podcast on Game Stop.

Short Squeeze: How Wall Street Bets went up against a hedge fund and sent GameStop stock to the moon. This is an interesting podcast if you want to peel back the onion on the Reddit GameStop controversy as told in four episodes. I really enjoyed it!

And one on Pinot.

Golden West: Ryan interviews Brandon Sparks-Gillis, the winemaker and co-founder of Dragonette Cellars. They discuss how Dragonette unofficially started in 2003 with 25 cases of Syrah, his background in Geology and the Santa Barbara County as a wine region. If you like wine, you will enjoy this interview.

I hope that you enjoy the letter as much as I enjoyed making it and please feel free to share the links with friends and associates and if you are interested in startups and are an accredited investor you can join over 750 other backers that follow my AngelList syndicate here.

Be well and stay safe. Sean Bill / MacroCrunch / Twitter